Energy

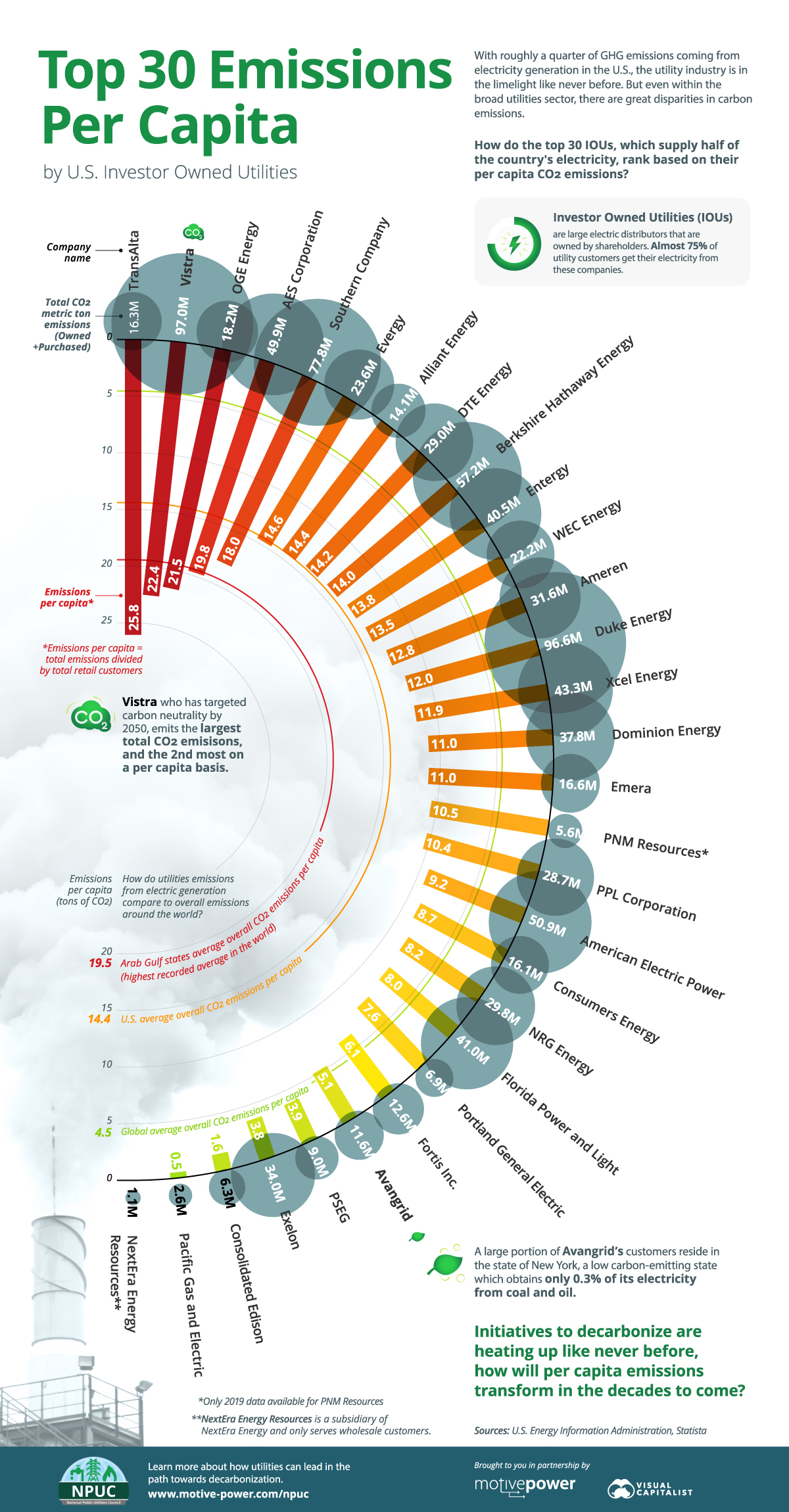

Ranked: Emissions per Capita of the Top 30 U.S. Investor-Owned Utilities

The following content is sponsored by the National Public Utilities Council

Emissions per Capita of the Top 30 U.S. Investor-Owned Utilities

Approximately 25% of all U.S. greenhouse gas emissions (GHG) come from electricity generation.

Subsequently, this means investor-owned utilities (IOUs) will have a crucial role to play around carbon reduction initiatives. This is particularly true for the top 30 IOUs, where almost 75% of utility customers get their electricity from.

This infographic from the National Public Utilities Council ranks the largest IOUs by emissions per capita. By accounting for the varying customer bases they serve, we get a more accurate look at their green energy practices. Here’s how they line up.

Per Capita Rankings

The emissions per capita rankings for the top 30 investor-owned utilities have large disparities from one another.

Totals range from a high of 25.8 tons of CO2 per customer annually to a low of 0.5 tons.

| Utility | Emissions Per Capita (CO2 tons per year) | Total Emissions (M) |

|---|---|---|

| TransAlta | 25.8 | 16.3 |

| Vistra | 22.4 | 97.0 |

| OGE Energy | 21.5 | 18.2 |

| AES Corporation | 19.8 | 49.9 |

| Southern Company | 18.0 | 77.8 |

| Evergy | 14.6 | 23.6 |

| Alliant Energy | 14.4 | 14.1 |

| DTE Energy | 14.2 | 29.0 |

| Berkshire Hathaway Energy | 14.0 | 57.2 |

| Entergy | 13.8 | 40.5 |

| WEC Energy | 13.5 | 22.2 |

| Ameren | 12.8 | 31.6 |

| Xcel Energy | 11.9 | 43.3 |

| Duke Energy | 11.1 | 88.9 |

| Dominion Energy | 11.0 | 37.8 |

| Emera | 11.0 | 16.6 |

| PPL Corporation | 10.7 | 29.6 |

| PNM Resources | 10.0 | 5.3 |

| American Electric Power | 9.2 | 50.9 |

| Consumers Energy | 8.7 | 16.1 |

| NRG Energy | 8.2 | 29.8 |

| Florida Power and Light | 8.0 | 41.0 |

| Portland General Electric | 7.6 | 6.9 |

| Fortis Inc. | 6.1 | 12.6 |

| Avangrid | 5.1 | 11.6 |

| PSEG | 3.9 | 9.0 |

| Exelon | 3.8 | 34.0 |

| Consolidated Edison | 1.6 | 6.3 |

| Pacific Gas and Electric | 0.5 | 2.6 |

| Next Era Energy Resources | 0 | 1.1 |

PNM Resources data is from 2019, all other data is as of 2020

Let’s start by looking at the higher scoring IOUs.

TransAlta

TransAlta emits 25.8 tons of CO2 emissions per customer, the largest of any utility on a per capita basis. Altogether, the company’s 630,000 customers emit 16.3 million metric tons. On a recent earnings call, its management discussed clear intent to phase out coal and grow their renewables mix by doubling their renewables fleet. And so far it appears they’ve been making good on their promise, having shut down the Canadian Highvale coal mine recently.

Vistra

Vistra had the highest total emissions at 97 million tons of CO2 per year and is almost exclusively a coal and gas generator. However, the company announced plans for 60% reductions in CO2 emissions by 2030 and is striving to be carbon neutral by 2050. As the highest total emitter, this transition would make a noticeable impact on total utility emissions if successful.

Currently, based on their 4.3 million customers, Vistra sees per capita emissions of 22.4 tons a year. The utility is a key electricity provider for Texas, ad here’s how their electricity mix compares to that of the state as a whole:

| Energy Source | Vistra | State of Texas |

|---|---|---|

| Gas | 63% | 52% |

| Coal | 29% | 15% |

| Nuclear | 6% | 9% |

| Renewables | 1% | 24% |

| Oil | 1% | 0% |

Despite their ambitious green energy pledges, for now only 1% of Vistra’s electricity comes from renewables compared to 24% for Texas, where wind energy is prospering.

Based on those scores, the average customer from some of the highest emitting utility groups emit about the same as a customer from each of the bottom seven, who clearly have greener energy practices. Let’s take a closer look at emissions for some of the bottom scoring entities.

Utilities With The Greenest Energy Practices

Groups with the lowest carbon emission scores are in many ways leaders on the path towards a greener future.

Exelon

Exelon emits only 3.8 tons of CO2 emissions per capita annually and is one of the top clean power generators across the Americas. In the last decade they’ve reduced their GHG emissions by 18 million metric tons, and have recently teamed up with the state of Illinois through the Clean Energy Jobs Act. Through this, Exelon will receive $700 million in subsidies as it phases out coal and gas plants to meet 2030 and 2045 targets.

Consolidated Edison

Consolidated Edison serves nearly 4 million customers with a large chunk coming from New York state. Altogether, they emit 1.6 tons of CO2 emissions per capita from their electricity generation.

The utility group is making notable strides towards a sustainable future by expanding its renewable projects and testing higher capacity limits. In addition, they are often praised for their financial management and carry the title of dividend aristocrat, having increased their dividend for 47 years and counting. In fact, this is the longest out of any utility company in the S&P 500.

A Sustainable Tomorrow

Altogether, utilities will have a pivotal role to play in decarbonization efforts. This is particularly true for the top 30 U.S. IOUs, who serve millions of Americans.

Ultimately, this means a unique moment for utilities is emerging. As the transition toward cleaner energy continues and various groups push to achieve their goals, all eyes will be on utilities to deliver.

The National Public Utilities Council is a collaborative body of industry experts coming together to solve decarbonization challenges in the power sector and the proud sponsor of the Decarbonization Channel.

Energy

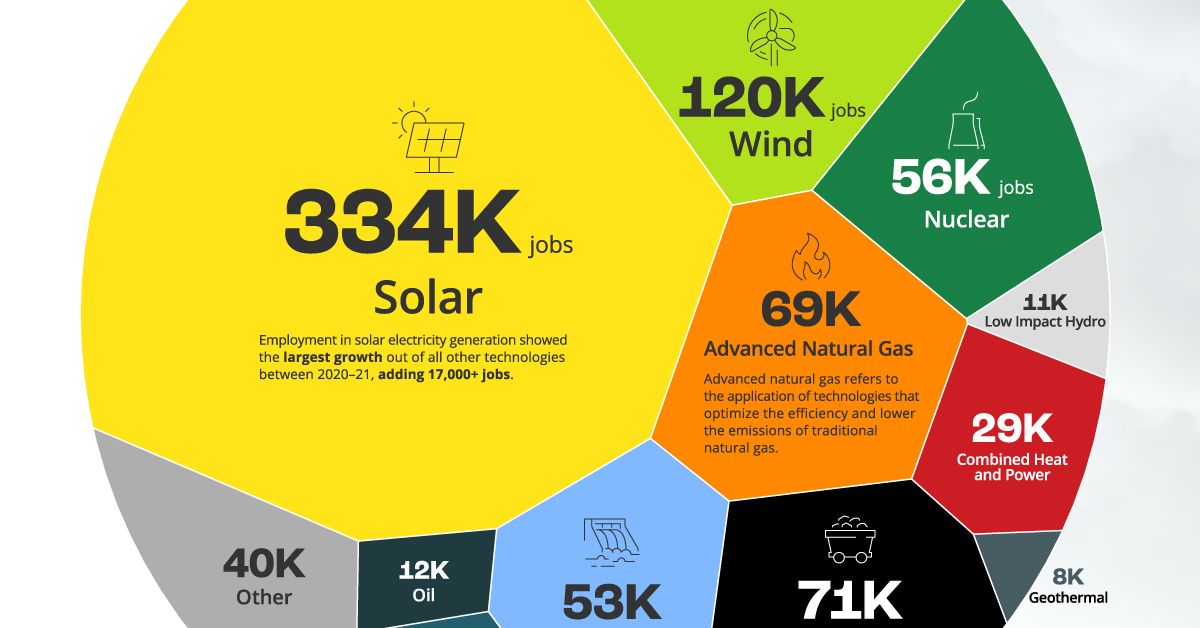

Visualizing U.S. Electricity Generation Jobs by Technology

Exploring U.S. electricity generation jobs by technology with a focus on renewable energy and workforce development.

Visualizing U.S. Electricity Generation Jobs by Technology

In 2021, 857,579 people were employed in the U.S. electricity generation sector.

To explore the distribution of this workforce, the above graphic by the National Public Utilities Council breaks down the number of jobs for each electricity generation technology using the U.S. Department of Energy’s Energy and Employment Report.

An Evolving Employment Landscape

The employment landscape within the U.S. electricity generation sector is continually evolving, driven by technological shifts, growing urgency towards decarbonization, and new policy initiatives.

Here are some interesting trends seen in 2021.

1. Solar Leads the Way with Significant Job Growth

The solar energy sector emerged as a shining star in 2021, witnessing substantial job growth compared to other electricity generation technologies. With a total of 333,887 jobs, solar not only topped the chart but also experienced a notable increase of over 17,000 jobs from the previous year.

This surge in solar jobs can be attributed to several factors, including advancements in technology, falling costs, and increased adoption of renewable energy sources across the country.

2. Advanced Natural Gas Employs More People Than Traditional

While renewable energy sources gained traction, advanced natural gas also played a significant role in the U.S. electricity generation sector with 69,113 jobs.

Advanced natural gas refers to the application of technologies that optimize efficiency and reduce the emissions associated with traditional natural gas.

As the fourth biggest employer on the list, advanced natural gas employed more people than traditional natural gas in 2021.

3. Renewable Energy Sector Outpaces Broader Sector Growth

Between 2020 and 2021, the renewable electricity generation sector experienced a robust growth rate of 4.4% in employment, outpacing the broader power generation sector’s growth rate of 2.9%.

The employment figures highlight the potential for continued job creation within the renewable sector as the transition to cleaner energy sources gains further momentum.

Getting Over the Workforce Development Hurdle

The employment figures in the U.S. electricity generation sector demonstrate promising growth in clean energy jobs. With that said, rapid decarbonization of the sector may still require a level of workforce development that hasn’t yet been seen in the United States.

As electric utilities and the nation at large strive to achieve their ambitious net-zero goals, investing more in workforce development can be an integral piece of the puzzle, specifically to help individuals transition smoothly from fossil fuel jobs to those in clean generation.

By addressing this challenge, the U.S. can ensure a well-prepared workforce that will drive the transition to a sustainable and net-zero future.

Energy

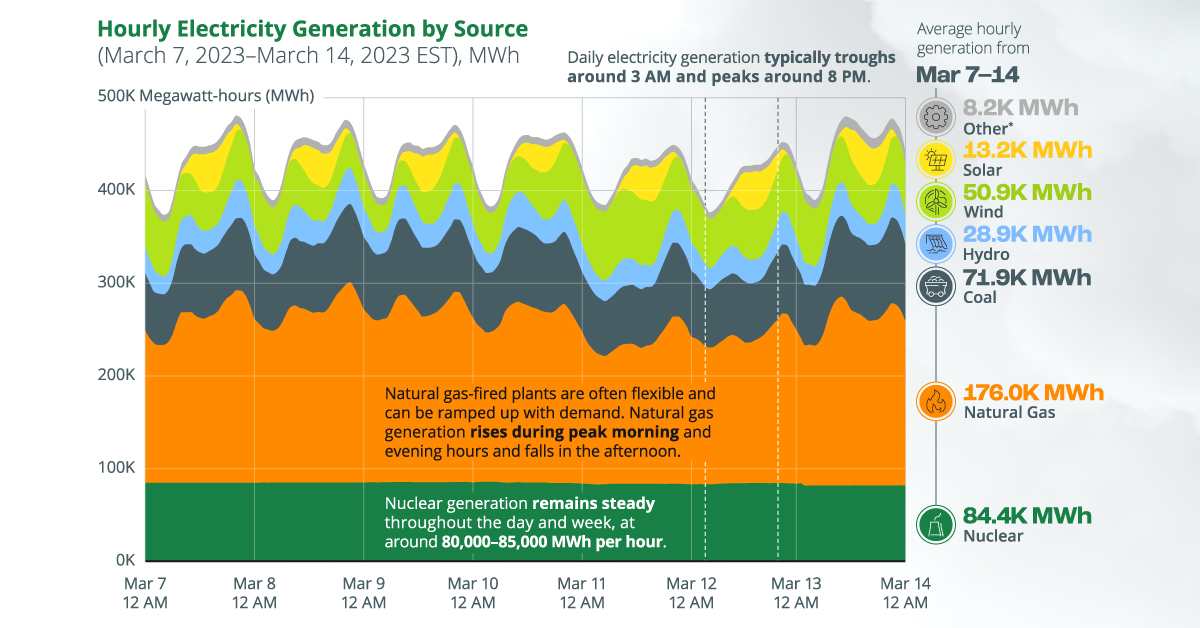

How Does U.S. Electricity Generation Change Over One Week?

This chart tracks U.S. hourly electricity generation over one week, with various sources producing electricity at different times of the day.

How Does U.S. Electricity Generation Change in a Week?

The U.S. has a dynamic electricity mix, with a range of energy sources generating electricity at different times of the day.

At all times, the amount of electricity generated must match demand in order to keep the power grid in balance, which leads to cyclical patterns in daily and weekly electricity generation.

The above graphic sponsored by the National Public Utilities Council tracks hourly changes in U.S. electricity generation over one week, based on data from the U.S. Energy Information Administration (EIA).

The Three Types of Power Plants

Before diving in, it’s important to distinguish between the three main types of power plants in the U.S. electricity mix:

- Base load plants generally run at full or near-full capacity and are used to meet the base load or the minimum amount of electricity demanded at all times. These are typically coal-fired or nuclear power plants. If regionally available, geothermal and hydropower plants can also be used as baseload sources.

- Peak load or peaking power plants are typically dispatchable and can be ramped up quickly during periods of high demand. These plants usually operate at maximum capacity only for a few hours a day and include gas-fired and pumped-storage hydropower plants.

- Intermediate load plants are used during the transitory hours between base load and peak load demand. Intermittent renewable sources like wind and solar (without battery storage) are suitable for intermediate use, along with other sources.

Zooming In: The U.S. Hourly Electricity Mix

With that context, the table below provides an overview of average hourly electricity generation by source for the week of March 7–March 14, 2023, in the Eastern Time Zone.

It’s worth noting that while this is representative of a typical week of electricity generation, these patterns can change with seasons. For example, in the month of June, electricity demand usually peaks around 5 PM, when solar generation is still high, unlike in March.

| Energy Source | Type | Avg. Hourly Electricity Generation, MWh (Mar 07–14, 2023, EST) |

|---|---|---|

| Natural Gas | Fossil fuel | 175,967 |

| Nuclear | Non-renewable | 84,391 |

| Coal | Fossil fuel | 71,922 |

| Wind | Renewable | 50,942 |

| Hydro | Renewable | 28,889 |

| Solar | Renewable | 13,213 |

| Other | Mixed | 8,192 |

Natural gas is the country’s largest source of electricity, with gas-fired plants generating an average of 176,000 MWh of electricity per hour throughout the week outlined above. The dispatchable nature of natural gas is evident in the chart, with gas-fired generation falling in the wee hours and rising during business hours.

Meanwhile, nuclear electricity generation remains steady throughout the given days and week, ranging between 80,000–85,000 MWh per hour. Nuclear plants are designed to operate for long durations (1.5 to 2 years) before refueling and require less maintenance, allowing them to provide reliable baseload energy.

On the other hand, wind and solar generation tend to see large fluctuations throughout the week. For example, during the week of March 07–14, wind generation ranged between 26,875 MWh and 77,185 MWh per hour, based on wind speeds. Solar generation had stronger extremes, often reaching zero or net-negative at night and rising to over 40,000 MWh in the afternoon.

Because wind and solar are often variable and location-specific, integrating them into the grid can pose challenges for grid operators, who rely on forecasts to keep electricity supply and demand in balance. So, what are some ways to solve these problems?

Solving the Renewable Intermittency Challenge

As more renewable capacity is deployed, here are three ways to make the transition smoother.

- Energy storage systems can be combined with renewables to mitigate variability. Batteries can store electricity during times of high generation (for example, in the afternoon for solar), and supply it during periods of peak demand.

- Demand-side management can be used to shift flexible demand to times of high renewable generation. For instance, utilities can collaborate with their industrial customers to ensure that certain factory lines only run in the afternoon, when solar generation peaks.

- Expanding transmission lines can help connect high-quality solar and wind resources in remote regions to centers of demand. In fact, as of the end of 2021, over 900 gigawatts of solar and wind capacity (notably more than the country’s current renewable capacity) were queued for grid interconnection.

-

Electrification1 year ago

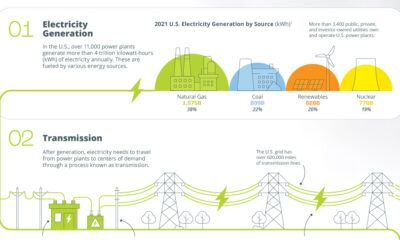

Electrification1 year agoVisualized: How the Power Grid Works

-

Energy Shift9 months ago

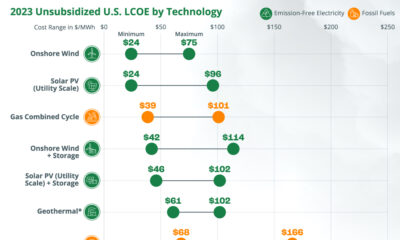

Energy Shift9 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

Energy Shift1 year ago

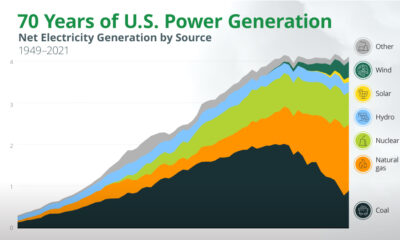

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

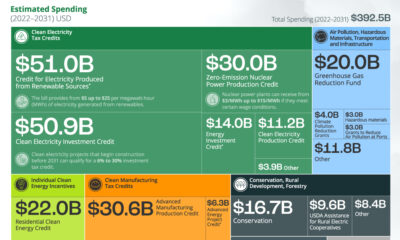

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Emissions1 year ago

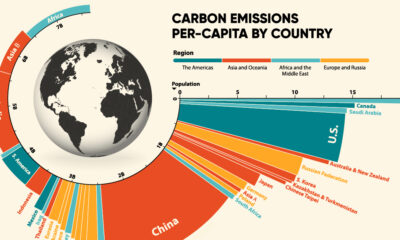

Emissions1 year agoVisualizing Global Per Capita CO2 Emissions

-

Clean Energy1 year ago

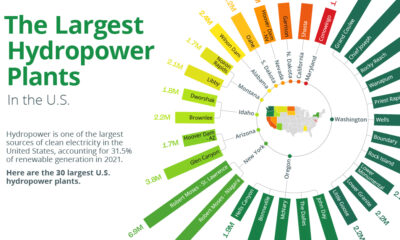

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

Decarbonization1 year ago

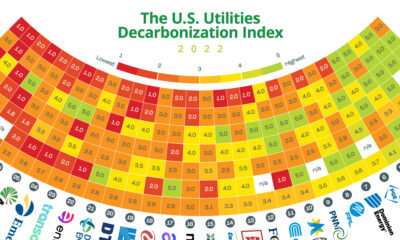

Decarbonization1 year agoThe U.S. Utilities Decarbonization Index

-

Clean Energy7 months ago

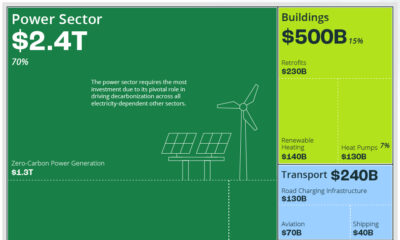

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition