Decarbonization

The U.S. Utilities Decarbonization Index

The data in this infographic comes from the NPUC Annual Utility Decarbonization Report 2022

The U.S. Utilities Decarbonization Index

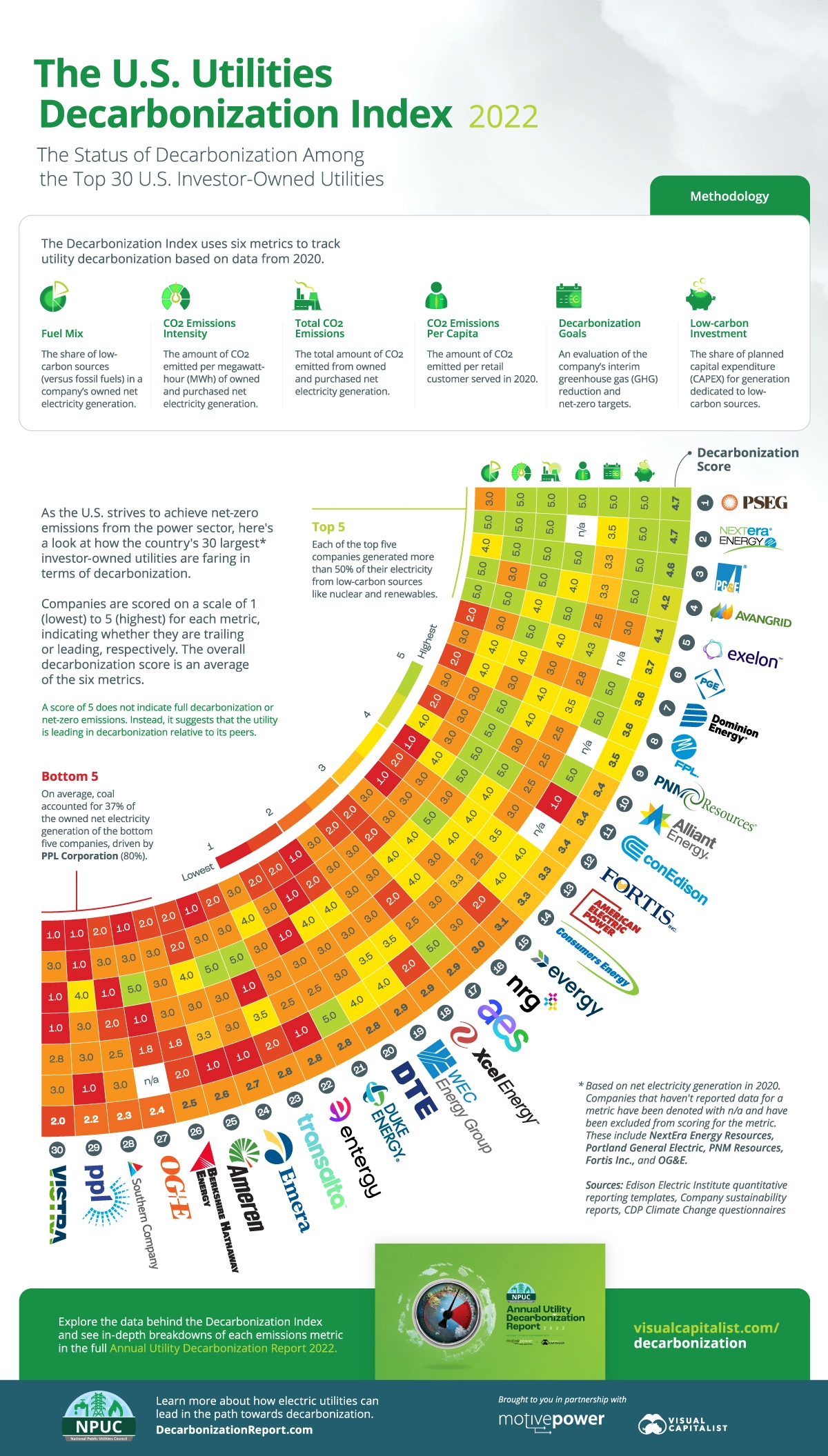

With the Biden administration targeting a zero-emissions power sector for the U.S. by 2035, how are the nation’s largest electric power providers faring in terms of decarbonization?

Together, Visual Capitalist and our sponsor National Public Utilities Council have developed the Annual Utility Decarbonization Index. The index quantifies and compares the status of decarbonization among the 30 largest investor-owned utilities in the United States.

Decarbonization is quantified by scoring companies on six emissions-related metrics based on publicly available data from 2020 (the latest available).

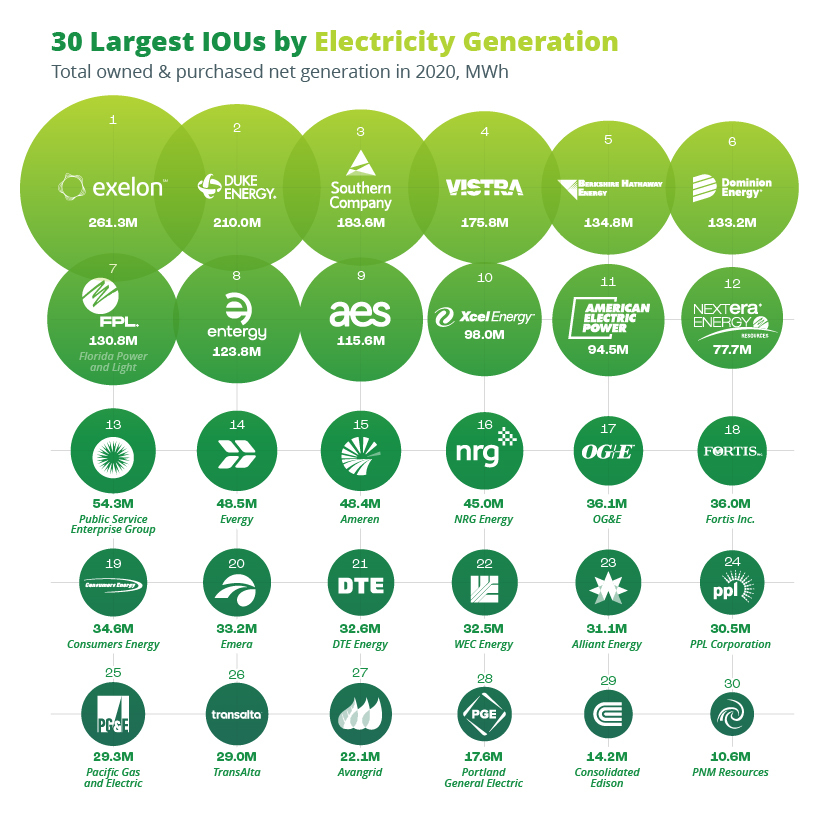

Why the 30 Largest IOUs?

Why does the Decarbonization Index specifically look at the 30 largest IOUs by electricity generation?

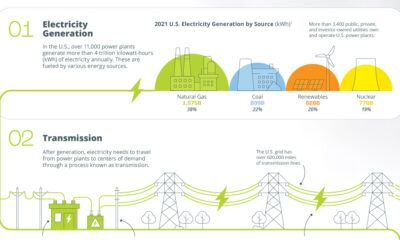

Well, these 30 utilities collectively generated around 2.3 billion megawatt hours (MWh) of electricity (including purchased power), making up over half of U.S. net electricity generation in 2020. Moreover, they also served over 90 million customers, accounting for roughly 56% of all electric customers in the country.

Therefore, it’s safe to say that the 30 largest IOUs have an important role in decarbonizing both the power sector and the U.S. economy. Since the residential, commercial, industrial, and agricultural sectors all use electricity, the decarbonization of utilities—the providers of electric power—can enable emissions reduction throughout the economy.

Decarbonization Index Methodology

For each of the six metrics used in the Decarbonization Index, utilities are scored on a scale of 1 (lowest) to 5 (highest), indicating whether they are trailing or leading, respectively. Scores for each metric are based on the range of figures for each metric divided into five equal buckets that the utilities fall into.

For simplicity, let’s suppose that the lowest reported total emissions figure is zero metric tons of carbon dioxide (CO2) and the highest is 100 metric tons. In that case, companies that emit fewer than 20 metric tons of CO2 will receive the highest score of 5. Those that emit between 20 and 40 metric tons of CO2 will receive a 4, and so on.

A utility’s overall decarbonization score is an average of their scores across the six metrics, summarized below:

- Fuel Mix: The share of low-carbon sources (renewables, nuclear, and fuel cells) in the utility’s owned net electricity generation. We’ve assumed that the share of low-carbon sources can range from 0% to 100%, and scores are assigned based on that range.

- CO2 Emissions Intensity: The amount of CO2 emitted per megawatt-hour of owned and purchased electricity generation.

- Total CO2 Emissions: The sum of absolute CO2 emissions from owned and purchased electricity generation. While this overlooks the differing sizes of utilities, the rationale is that smaller unconsolidated utilities may find it easier to decarbonize than larger peers.

- CO2 Emissions per Capita: The amount of CO2 emitted from owned and purchased electricity generation per retail customer served in 2020.

- Decarbonization Goals: An evaluation of the utility’s interim greenhouse gas (GHG) emissions reduction goals and net-zero targets. The baseline for this is 50% GHG emissions reduction by 2030 and net-zero emissions by 2050 (utilities with baseline targets get a score of 2.5/5).

- Low-Carbon Investment: The share of planned capital expenditure (CAPEX) for electricity generation that is allocated to low-carbon sources. We’ve assumed that the share of CAPEX for low-carbon sources can range from 0% to 100%, and scores are assigned based on that range.

The data for these metrics comes from various sources including company sustainability reports, quantitative reporting templates from the Edison Electric Institute, and the Climate Disclosure Project’s Climate Change Questionnaire filings.

Explore all six metrics of the U.S. Utility Decarbonization Index

Download The NPUC Annual Utility Decarbonization Report for free.

The Annual Utility Decarbonization Index 2022

Before looking at numbers, it’s important to note that the Decarbonization Index is relative and compares the 30 largest IOUs to each other. Therefore, a score of 5 does not indicate full decarbonization or net-zero emissions. Instead, it suggests that the utility is doing particularly well relative to its peers.

With that in mind, here’s a look at the Annual Utility Decarbonization Index 2022:

| Rank | Company | Decarbonization Score |

|---|---|---|

| #1 | Public Service Enterprise Group | 4.7 |

| #2 | NextEra Energy Resources | 4.7 |

| #3 | Pacific Gas and Electric | 4.5 |

| #4 | Avangrid | 4.2 |

| #5 | Exelon | 4.1 |

| #6 | Portland General Electric | 3.7 |

| #7 | Dominion Energy | 3.6 |

| #8 | Florida Power and Light | 3.6 |

| #9 | PNM Resources | 3.5 |

| #10 | Alliant Energy | 3.4 |

| #11 | Consolidated Edison | 3.4 |

| #12 | Fortis Inc. | 3.4 |

| #13 | American Electric Power | 3.3 |

| #14 | Consumers Energy | 3.3 |

| #15 | Evergy | 3.0 |

| #16 | NRG Energy | 3.0 |

| #17 | AES Corporation | 2.9 |

| #18 | Xcel Energy | 2.9 |

| #19 | WEC Energy | 2.9 |

| #20 | DTE Energy | 2.8 |

| #21 | Duke Energy | 2.8 |

| #22 | Entergy | 2.8 |

| #23 | TransAlta | 2.8 |

| #24 | Emera | 2.7 |

| #25 | Ameren | 2.6 |

| #26 | Berkshire Hathaway Energy | 2.5 |

| #27 | Oklahoma Gas & Electric Company | 2.4 |

| #28 | Southern Company | 2.3 |

| #29 | PPL Corporation | 2.2 |

| #30 | Vistra Corp. | 2.0 |

A small number of companies did not report data on certain metrics and have been excluded from scoring for those metrics (denoted as N/A). In such cases, the decarbonization score is an average of five metrics instead of six.

Public Service Enterprise Group (PSEG), headquartered in New Jersey, tops this year’s rankings thanks to its low-emissions profile and ambitious climate goals. The company is aiming to achieve net-zero emissions from operations by 2030—five years ahead of the Biden Administration’s target and faster than any other utility on the list.

Tied with PSEG is NextEra Energy Resources, the clean energy-focused subsidiary of NextEra Energy. The company is the world’s largest producer of solar and wind power and generated 97% of its net electricity from low-carbon sources in 2020.

In third place is California’s largest utility, the Pacific Gas and Electric Company (PG&E). PG&E had the lowest emissions per capita of the 30 largest IOUs at 0.5 metric tons of CO2 per retail customer in 2020. That figure is significantly lower than the average of 11.5 metric tons across the 30 IOUs.

Rounding out the top five are Avangrid, a renewables-focused U.S. subsidiary of the Spanish Iberdrola Group, and Exelon, the nation’s largest utility by number of retail customers. Avangrid had one of the cleanest fuel mixes with 87% of its owned net electricity coming from low-carbon sources. Exelon is the nation’s largest provider of emissions-free electricity, generating around 157 million MWh or 86% of its owned net electricity from nuclear power.

Download the Full Utility Decarbonization Report

While the Decarbonization Index provides a look at the current status of utility decarbonization, there’s much more to uncover in the full report, including:

- The obstacles that utilities face on the path to decarbonization

- The detailed data behind the six individual metrics

- The U.S. utilities ESG report card

- The solutions and strategies that can help accelerate decarbonization

Download the full report and find out everything you need to know about utility decarbonization.

Decarbonization

Unpacking Hydrogen’s Role in Decarbonizing the Electricity Sector

In this infographic, we discuss three ways hydrogen can support the decarbonization of the global electricity sector.

Hydrogen’s Role in Decarbonizing the Electricity Sector

Hydrogen constitutes 75% of the elemental mass in our universe.

According to the International Energy Agency (IEA), it could also play a pivotal role in global decarbonization efforts.

This infographic, created in partnership with the National Public Utilities Council, explores three ways this element could support the decarbonization of the global electricity sector.

Hydrogen 101

First, let’s get a few basics about hydrogen out of the way.

While abundant in nature, hydrogen is rarely found in its elemental state (H2) on Earth, meaning that it needs to be separated from other chemical compounds, such as water (H2O). Once extracted, however, it becomes a versatile and energy-dense fuel source, containing approximately three times the energy content of gasoline or natural gas.

There are several methods to extract hydrogen from compounds. Depending on the production method and energy source, the resulting hydrogen is often categorized by color to show its emission impact.

| Color | Hydrogen Production Method | Energy Source |

|---|---|---|

| Black | Gasification | Coal or Lignite |

| Gray | Steam Methane Reforming (SMR) | Natural Gas |

| Blue | SMR + Carbon Capture and Storage (CCS) | Natural Gas |

| Purple* | Electrolysis | Nuclear Energy |

| Green | Electrolysis | Renewable Energy |

*Purple hydrogen is also referred to as red or pink hydrogen.

Today, black, gray, and blue hydrogen are used in emission-heavy industries such as petroleum refining and ammonia production.

The technology and infrastructure for purple and green hydrogen, on the other hand, are still taking shape. As they progress, these emission-free sources of hydrogen are expected to play a pivotal role in decarbonizing many hard-to-abate sectors, including power.

Three Ways Green Hydrogen Can Help Decarbonize

Now that we’ve covered hydrogen basics, let’s dive into where emission-free hydrogen can fit in the race to decarbonize our global electricity system.

#1: Hydrogen and Natural Gas Blending

Hydrogen can be blended with natural gas in existing pipeline infrastructure for lower-emission power generation.

According to Jenbacher, a 20–30% hydrogen volume can lead to a 7–11% decrease in CO2 emissions, compared to natural gas on its own.

In 2022, U.S. electricity from natural gas generated 743 million metric tons in the United States. A 9% reduction in emissions through hydrogen blending lowers emissions by 67 million metric tons CO2, all without the need to build new infrastructure.

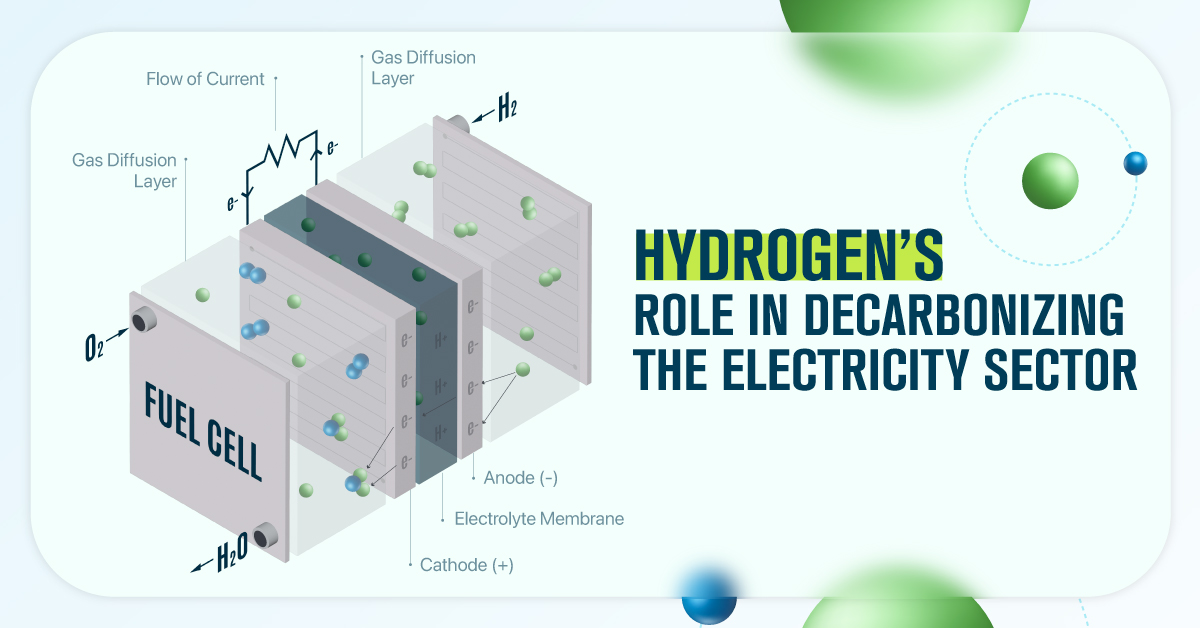

#2: Fuel Cells

A fuel cell generates electricity through an electrochemical reaction between hydrogen and oxygen, with water as the only byproduct.

By using green or pink hydrogen, fuel cells can provide 100% emission-free electricity that is also efficient, reliable, and dispatchable.

#3: Energy Storage

Energy storage plays a pivotal role in decarbonizing the power sector by balancing the intermittent nature of renewables.

While other technologies, such as lithium-ion batteries, can also provide energy storage, hydrogen has a greater potential to offer both large-scale and long-term storage, up to several months at a time.

As technology advances, the IEA predicts that global underground hydrogen capacity will grow by more than 200,000% in the next 30 years, reaching 1,200 TWh in 2050. That amount of energy can power 70,000 U.S. homes for an entire year, underscoring the untapped potential that lies within hydrogen.

Learn how the National Public Utilities Council is working towards the future of sustainable electricity.

Climate

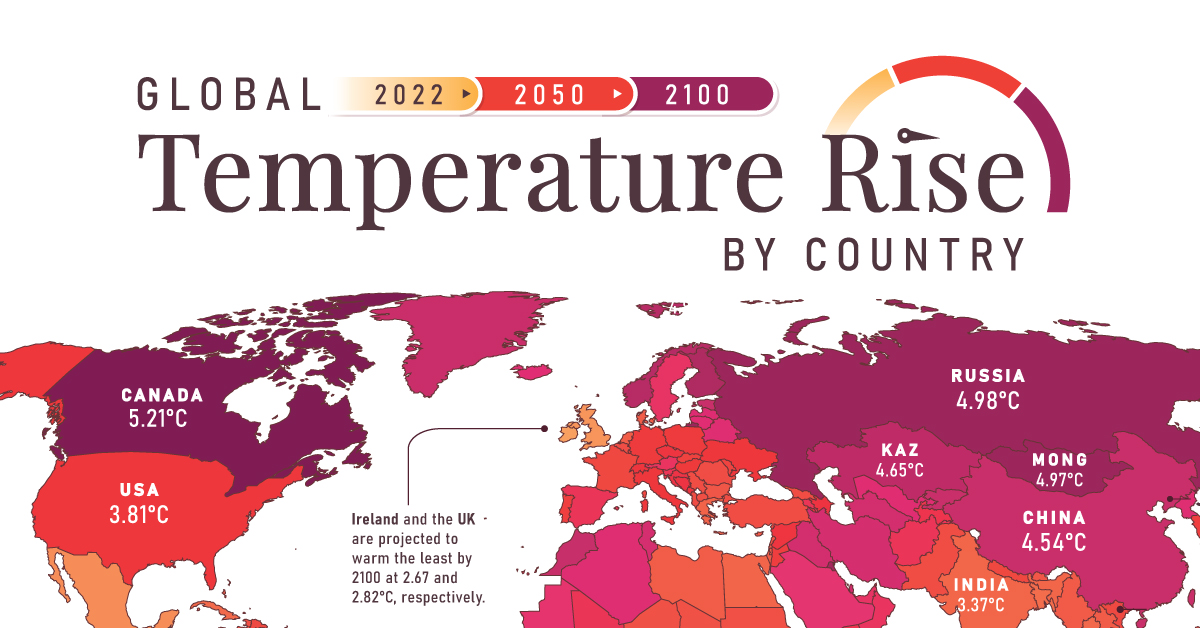

Mapped: Global Temperature Rise by Country (2022-2100P)

In this set of three maps, we show the global temperature rise on a national level for 2022, 2050, and 2100 based on an analysis by Berkeley Earth.

Mapped: Global Temperature Rise by Country (2022-2100P)

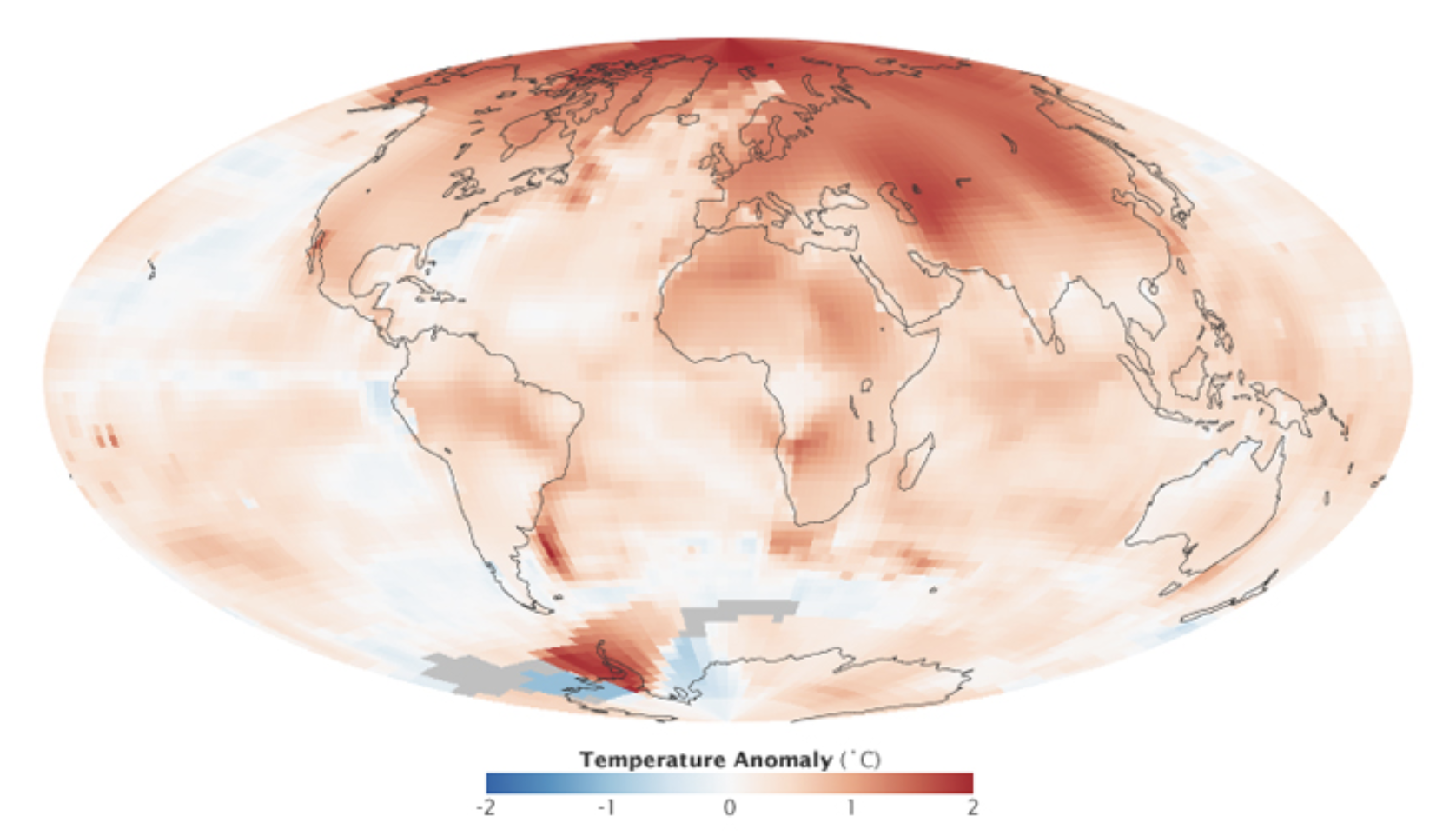

Many scientific authorities, such as the Intergovernmental Panel on Climate Change (IPCC), often discuss the need to limit planetary warming to 2°C above pre-industrial levels.

But did you know that this warming will not be evenly distributed throughout the globe due to factors such as geography, weather patterns, ocean currents, and the influence of human activities?

To discover the current and projected nuances of this uneven warming, these three maps created in partnership with the National Public Utilities Council visualize the global temperature rise by country, using new and updated data from Berkeley Earth.

Current State of Warming

The three maps above visualize warming relative to each country’s average 1850-1900 temperatures.

Looking at warming in 2022, we see that average national warming (i.e. warming excluding oceans) is already 1.81°C above those numbers, with Mongolia warming the most (2.54°C) and Bangladesh warming the least (1.1°C).

As the map depicts, warming is generally more accelerated in the Global North. One of the reasons for this is Arctic amplification.

Arctic amplification refers to the disproportionate heating experienced in the Arctic compared to the rest of the planet. This amplification is fueled by multiple feedback loops, including decreased albedo as ice cover diminishes, leading to further absorption of heat and exacerbating the warming effect.

Arctic amplification. Source: NASA

Aside from modern-day observations, the effects of Arctic amplification are also clearly seen in climate models, where accelerated warming in countries such as Russia and Canada is seen through 2100.

Projected Warming in 2050 and 2100

Moving over to the second and third maps in the slides above, we discover country-level 2050 and 2100 warming projections.

These projections are based on the IPCC’s “middle-of-the-road” scenario, titled Shared Socioeconomic Pathway (SSP) 2-4.5. Out of the various established pathways, this one is the closest to expected emissions under current policies.

2050 Projections

Under the SSP2-4.5 scenario, average national warming is projected to be 2.75°C above average 1850-1900 temperatures in 2050. This includes Mongolia, with the most substantial warming of 3.76°C, and New Zealand, with the mildest warming of 2.02°C.

To put those temperatures into context, here are the risks that would likely accompany them, according to the IPCC’s latest assessment report.

- Extreme weather events will be more frequent and intense, including heavy precipitation and related flooding and cyclones.

- Nearly all ecosystems will face high risks of biodiversity loss, including terrestrial, freshwater, coastal and marine ecosystems.

- Accelerated sea level rise will threaten coastal cities, leading to mass displacement.

Let’s now take a look at 2100 projections, which would have significantly higher levels of risk unless fast and extreme mitigation and adaptation measures are implemented in the upcoming decades.

2100 Projections

2100 projections under the SSP2-4.5 scenario depict an average national warming of 3.80°C.

More than 55 countries across the globe are projected to have warming above 4°C in comparison to their 1850-1900 averages, and nearly 100 above 3.5°C.

Here is what those levels of warming would likely mean, according to the IPCC.

- 3-39% of terrestrial species will face very high risks of extinction.

- Water scarcity will considerably affect cities, farms, and hydro plants, and about 10% of the world’s land area will experience rises in both exceptionally high and exceptionally low river flows.

- Droughts, floods, and heatwaves will pose substantial threats to global food production and accessibility, eroding food security and impacting nutritional stability on a significant scale.

Generally, warming at this level is expected to pose substantial catastrophic risks to humanity, necessitating swift and bold climate action.

Learn more about how electric utilities and the power sector can lead on the path toward decarbonization here.

-

Electrification1 year ago

Electrification1 year agoVisualized: How the Power Grid Works

-

Energy Shift9 months ago

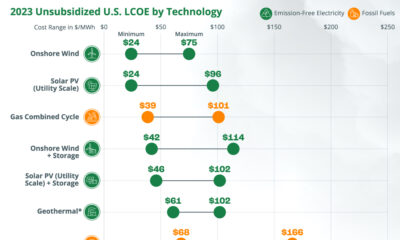

Energy Shift9 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

Energy Shift1 year ago

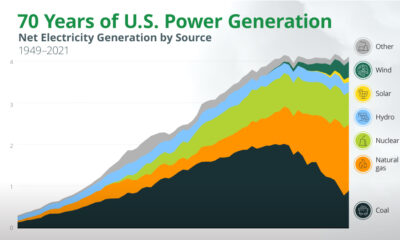

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

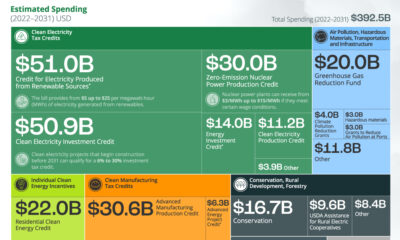

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Emissions1 year ago

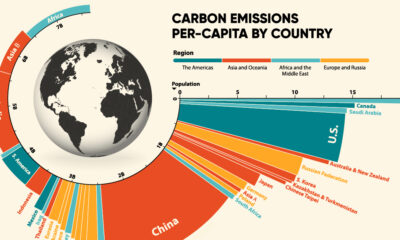

Emissions1 year agoVisualizing Global Per Capita CO2 Emissions

-

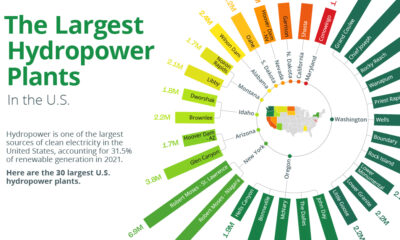

Clean Energy1 year ago

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

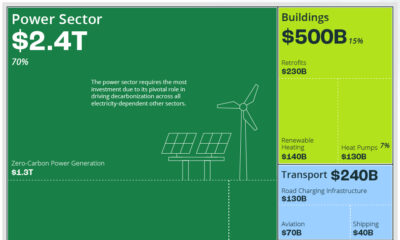

Clean Energy6 months ago

Clean Energy6 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition

-

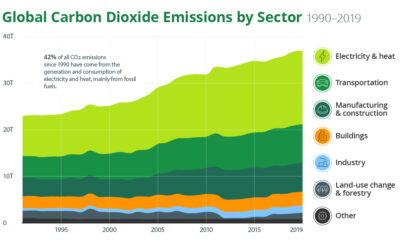

Climate1 year ago

Climate1 year agoVisualizing the State of Climate Change