Energy Shift

Visualizing U.S. Greenhouse Gas Emissions by Sector

The following content is sponsored by National Public Utilities Council

Visualizing U.S. Emissions by Sector

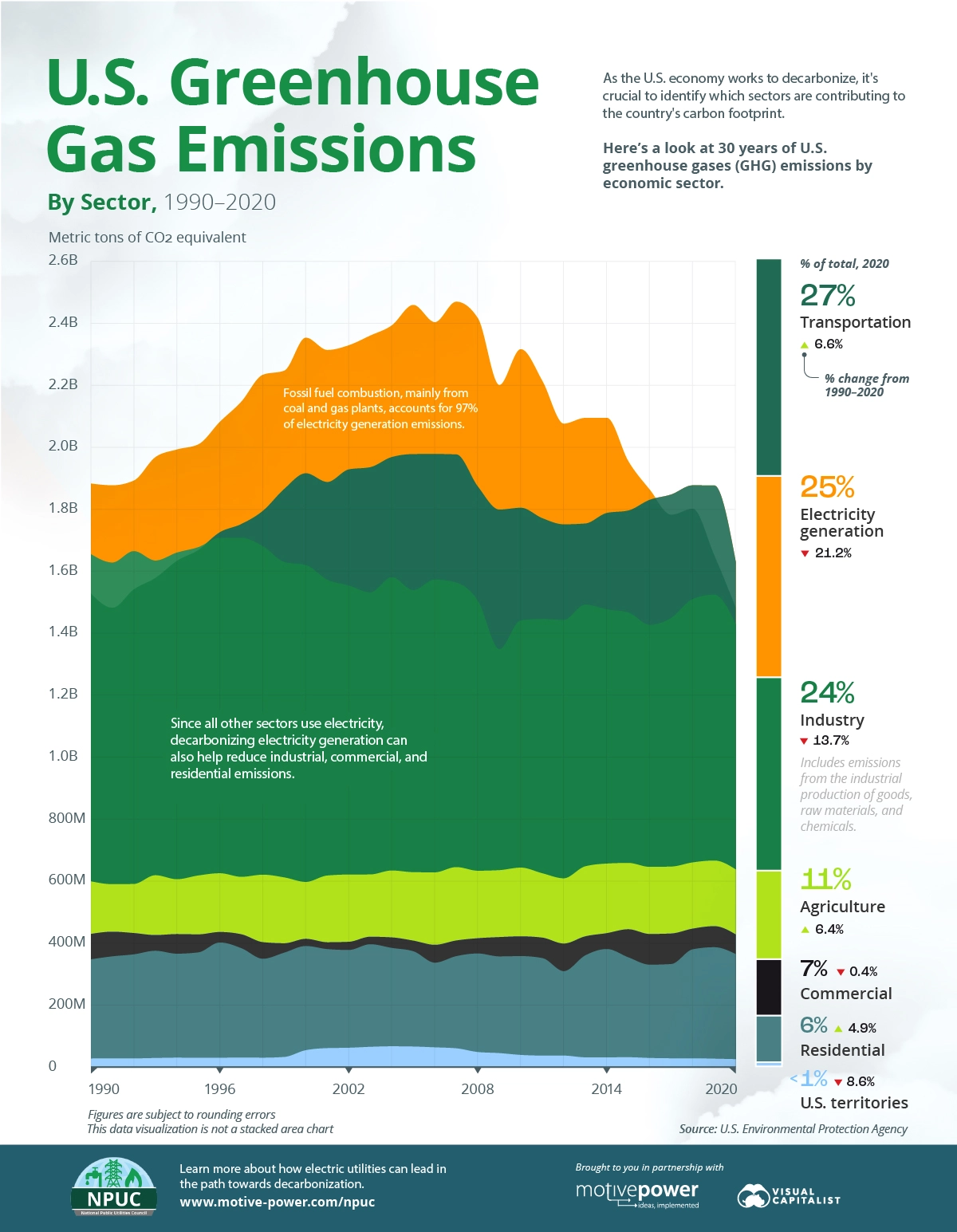

Decarbonization efforts in the U.S. are ramping up, and in 2020, greenhouse gas (GHG) emissions were lower than at any point during the previous 30 years.

However there’s still work to be done before various organizations, states, and nationwide targets are met. And when looking at GHG emissions by sector, the data suggests that some groups have more work cut out for them than others.

This graphic from the National Public Utilities Council provides the key data and trends on the total emissions by U.S. sector since 1990.

The Highest Emitting Sectors

Collectively, the U.S. emitted 5,981 million metric tons (MMT) of CO2-equivalent (CO2e) emissions in 2020, which rose 6.1% in 2021.

Here’s how the various sectors in the U.S. compare.

| Sector | 2020 GHG emissions, MMT CO2e | Percentage of Total |

|---|---|---|

| Transportation | 1,627.6 | 27% |

| Electricity generation | 1,482.6 | 25% |

| Industry | 1,426.2 | 24% |

| Agriculture | 635.1 | 11% |

| Commercial | 425.3 | 7% |

| Residential | 362.0 | 6% |

| U.S. territories | 23.0 | <1% |

The transportation sector ranks highest by emissions and has been notably impacted by the COVID-19 pandemic, which is still affecting travel and supply chains. This has led to whipsawing figures during the last two years.

For instance, in 2020, the transportation sector’s emissions fell 15%, the steepest fall of any sector. But the largest increase in emissions in 2021 also came from transportation, which is largely credited to the economic and tourism recovery last year.

Following transportation, electricity generation accounted for a quarter of U.S. GHG emissions in 2020, with fossil fuel combustion making up nearly 99% of the sector’s emissions. The other 1% includes waste incineration and other power generation technologies like renewables and nuclear power, which produce emissions during the initial stages of raw material extraction and construction.

Decarbonizing the Power Sector

The Biden Administration has set a goal to make the U.S. power grid run on 100% clean energy by 2035—a key factor in achieving the country’s goal of net zero emissions by 2050.

Industrial factories, commercial buildings, and homes all consume electricity to power their machinery and appliances. Therefore, the power sector can help reduce their carbon footprint by supplying more clean electricity, although this largely depends on the availability of infrastructure for transmission.

Here’s how sectors would look if their respective electricity end-use is taken into account

| Sector | Emissions by Sector % of Total |

|---|---|

| Agriculture | 11% |

| Transportation | 27% |

| Industry | 30% |

| Residential & Commercial | 30% |

Percentages may not add up to 100% due to independent rounding

With these adjustments, the industrial, commercial, and residential sectors experience a notable jump, and lead ahead of other categories

Today, the bulk of electricity generation, 60%, comes from natural gas and coal-fired power plants, with nuclear, renewables, and other sources making up 40% of the total.

| Energy Source | 2020 Electric generation, billion kWh | Share of total |

|---|---|---|

| Natural Gas | 1,575 | 38.3% |

| Coal | 899 | 21.8% |

| Nuclear | 778 | 18.9% |

| Wind | 380 | 9.2% |

| Hydropower | 260 | 6.3% |

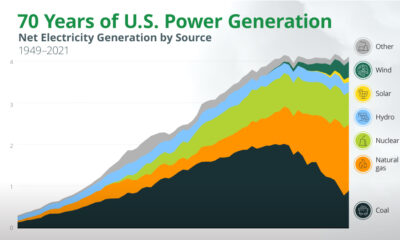

However, progress and notable strides have been made towards sustainable energy. In 2021, renewables accounted for one-fifth of U.S. electricity generation, roughly doubling their share since 2010.

Coal’s share as a source of electric power has dropped dramatically in recent years. And partially as a result, electricity generation has seen its portion of emissions successfully decrease by 21% , with overall emissions falling from 1,880 million metric tons of CO2 to 1,482 million metric tons.

How Utilities Can Lead the Way

Should these trends persist, the electricity generation sector has a chance to play a pivotal role in the broader decarbonization initiative. And with the bulk of electricity generation in the U.S. coming from investor-owned utilities (IOUs), this is a unique opportunity for IOUs to lead the transition toward cleaner energy.

The National Public Utilities Council is a collaborative body of industry experts coming together to solve decarbonization challenges in the power sector and the proud sponsor of the Decarbonization Channel.

Energy Shift

Mapped: The Age of Energy Projects in Interconnection Queues, by State

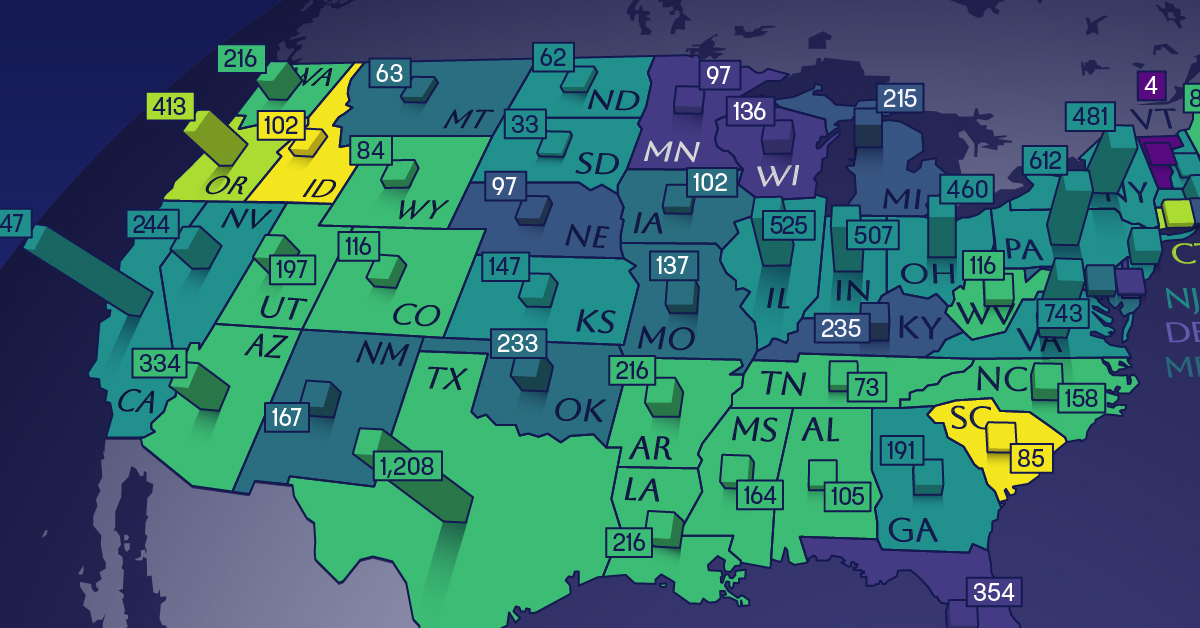

This map shows how many energy projects are in interconnection queues by state and how long these projects have been queued up, on average.

U.S. Energy Projects in Interconnection Queues, by State

By the end of 2023, more than 11,000 energy projects were in interconnection queues in the United States, waiting for a green-light from regional grid operators to proceed with construction.

This map, sponsored by the National Public Utilities Council, maps out the average age of active energy projects in interconnection queues by state, using data from Berkeley Lab.

Interconnection Queues, Explained

Interconnection queues are lists of energy projects that have made interconnection requests to their regional grid operators. Once submitted, these requests formally initiate the impact study process that each project goes through before grid connection, forming waiting lists for approval known as interconnection queues.

In recent years, both the number and generation capacity of queued projects have surged in the United States, along with the length of time spent in queue.

According to Berkeley Lab, the amount of generation capacity entering queues each year has risen by more than 550% from 2015 to 2023, with average queue duration rising from 3 years to 5 years the same period.

As a result of the growing backlog, a large proportion of projects ultimately withdraw from queues, leading to only 19% of applications reaching commercial operations.

The Backlog: Number of Projects and Average Wait Times

Of the 11,000 active projects in U.S. queues at the end of 2023, Texas, California, and Virginia had the most in queue; 1,208, 947, and 743, respectively.

When looking at the average ages of these projects, all three states hovered around the national average of 34 months (2.83 years), with Texas sporting 28 months, California 33, and Virginia 34.

Vermont, Minnesota, Wisconsin, and Florida, on the other hand, had the highest average queue durations; 54, 49, 47, and 46 months, respectively.

Average Queue Duration by Project Type

At the end of 2023, more than 95% of the generation capacity in active interconnection queues was for emission-free resources. The table below provides a breakdown.

| Project Type | Average Queue Duration (As of 12/31/2023) | Number of Projects in Queue |

|---|---|---|

| Wind | 40 months | 841 |

| Solar | 34 months | 4,506 |

| Wind+Battery | 34 months | 76 |

| Solar+Battery | 27 months | 2,377 |

| Battery | 24 months | 2,818 |

Wind projects had the highest wait times at the end of 2023 with an average age of 40 months (3.33 years). Solar projects, on the other hand, made up more than 40% of projects in queue.

Overall, reducing the time that these renewable energy projects spend in queues can accelerate the transition to a low-carbon energy future.

According to the U.S. Department of Energy, enhancing data transparency, streamlining approval processes, promoting economic efficiency, and maintaining a reliable grid are some of the ways this growing backlog can be mitigated.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

Energy Shift

All Commercially Available Long Duration Energy Storage Technologies, in One Chart

In this chart, we break down the parameters of LDES technologies that have commercial or pre-commercial readiness.

All Commercially Available Long Duration Energy Storage Technologies, in One Chart

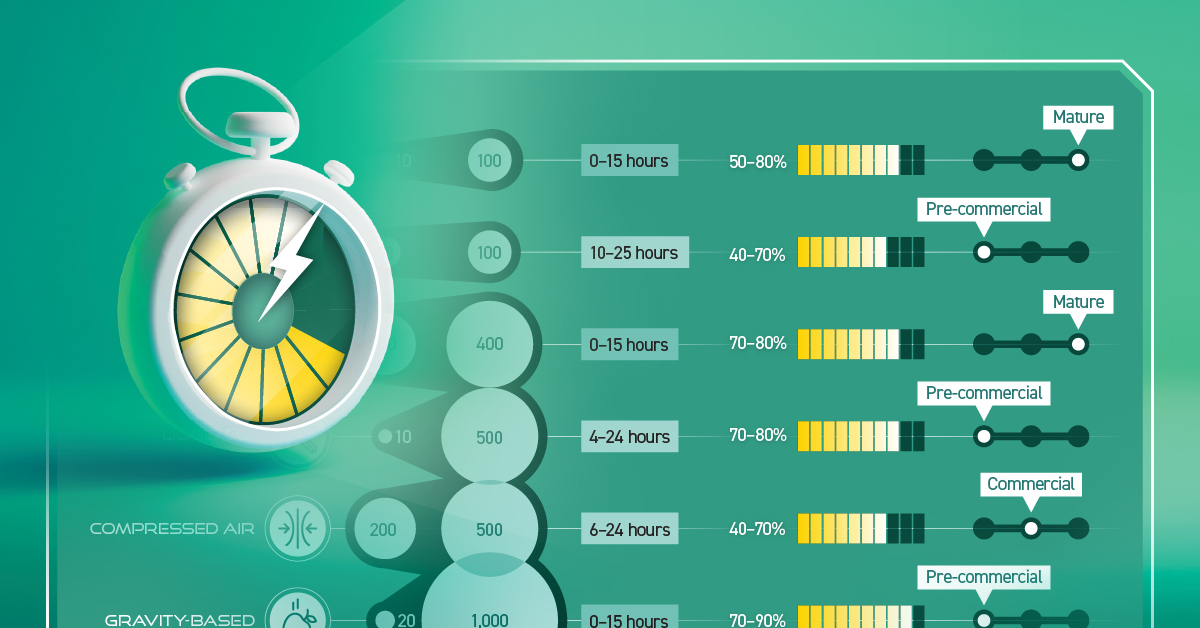

Long duration energy storage (LDES) technologies can store electricity for 10+ hours, complementing intermittent renewables, boosting grid resiliency, and reducing fossil fuel dependency.

Created in partnership with the National Public Utilities Council, this chart lists the characteristics of LDES technologies that have commercial or pre-commercial readiness, using data from the LDES Council’s Net-Zero Power report and 2023 deployment update.

The Four Primary Types of LDES

Before getting into the details, let’s cover the four primary types of LDES.

- Mechanical: Stores potential energy (by tension or position)

- Thermal: Stores energy as heat

- Chemical: Stores energy found within chemical bonds

- Electrochemical (batteries): Stores energy of chemical reactions, where electrical energy is converted to chemical energy and vice versa

Currently, mechanical storage systems are the most common around the world. Aboveground pumped hydropower, for instance, currently accounts for 96% of all utility-scale energy storage in the United States.

How Do LDES Technologies Measure Up?

Below, we list the storage capacity, storage duration, and average round-trip efficiency (RTE) of LDES technologies that have commercial or pre-commercial readiness on a global scale.

For context, RTE measures the effectiveness of a storage system by measuring the ratio of energy output to energy input during a full charge-discharge cycle. Or briefly, the higher the RTE, the lower the losses and therefore higher the efficiency.

| Form of Energy Storage | LDES Technology | Storage Capacity (MW) | Nominal Duration (Hours) | Average Round-Trip Efficiency |

|---|---|---|---|---|

| Mechanical | Underground pumped hydro | 10–100 | 0–15 | 50–80% |

| Mechanical | Liquid air | 50–100 | 10–25 | 40–70% |

| Mechanical | Aboveground pumped hydro | 200–400 | 0–15 | 70–80% |

| Mechanical | Liquid CO2 | 10–500 | 4–24 | 70–80% |

| Mechanical | Compressed air | 200–500 | 6–24 | 40–70% |

| Mechanical | Gravity-based | 20–1,000 | 0–15 | 70–90% |

| Thermal | Sensible heat | 10–500 | 200 | 55–90% |

| Chemical | Power-to-gas-to-power | 10–100 | 500–1,000 | 40–70% |

| Electrochemical | Aqueous electrolyte flow battery | 10–100 | 25–100 | 50–80% |

| Electrochemical | Metal anode battery | 10–100 | 50–200 | 40–70% |

| Electrochemical | Hybrid flow battery (with liquid electrolyte and metal anode) | >100 | 8–50 | 55–75% |

The table above shows that a mechanical, gravity-based LDES system can provide the highest storage capacity while presenting an impressive 70–90% average RTE.

On the other hand, a chemical power-to-gas-to-power system, which typically converts electricity to hydrogen gas and back to electricity, provides the highest storage duration of up to 1,000 hours.

With that said, there are different storage needs and siting considerations across electrical grids. Given the diverse range of options available, suitable solutions can be found to complement renewables and aid decarbonization.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

-

Energy Shift10 months ago

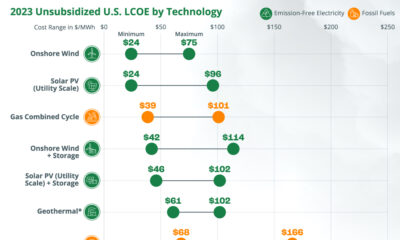

Energy Shift10 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

Electrification2 years ago

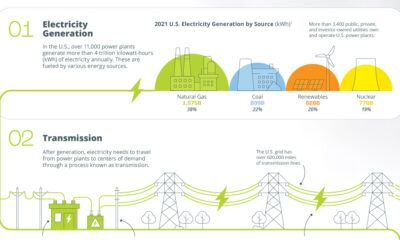

Electrification2 years agoVisualized: How the Power Grid Works

-

Energy Shift1 year ago

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

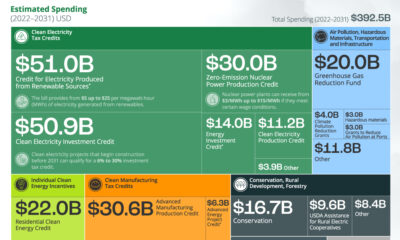

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

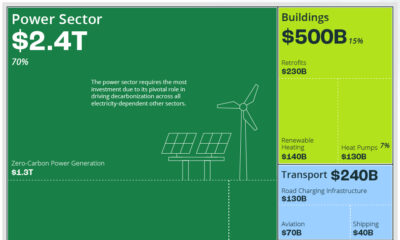

Clean Energy7 months ago

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition

-

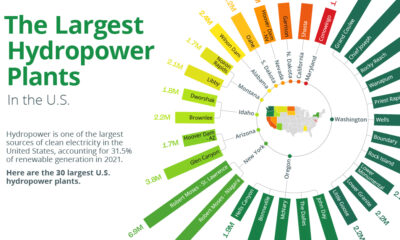

Clean Energy1 year ago

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

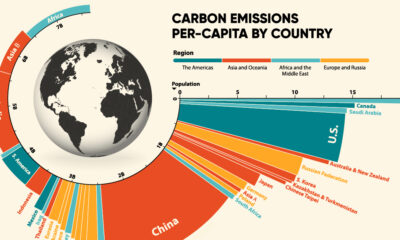

Emissions2 years ago

Emissions2 years agoVisualizing Global Per Capita CO2 Emissions

-

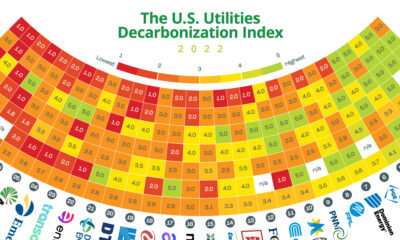

Decarbonization2 years ago

Decarbonization2 years agoThe U.S. Utilities Decarbonization Index