Decarbonization

Visualized: Carbon Pricing Initiatives in North America

The following content is sponsored by the National Public Utilities Council

Visualized: Carbon Pricing Initiatives in North America

Carbon pricing mechanisms are a vital component of an effective emissions reduction strategy. But these initiatives currently cover just 15% of total North American carbon emissions.

To discover which initiatives are currently contributing to this coverage, this graphic sponsored by the National Public Utilities Council maps out all of the national and subnational carbon pricing initiatives across North America using data from the World Bank.

Let’s begin by looking at types of carbon pricing.

Carbon Pricing Explained

Carbon pricing is a market-based policy tool that assigns a cost to carbon emissions, incentivizing reductions through the use of economic signals.

While there are several ways to go about carbon pricing, the most commonly used types of carbon pricing strategies include:

- Emissions Trading Systems (ETS)

ETS establishes a market for trading emissions allowances among companies. A cap on total emissions is set, and all companies receive tradable emission units. Those exceeding their limits can buy allowances from those with a surplus. - Carbon Taxes

Carbon taxes impose a direct price on carbon emissions. Their goal is to disincentivize carbon-intensive activities, such as burning fossil fuels, by making them financially less attractive.

In 2022, carbon pricing strategies generated $5 billion in the U.S. and $8 billion in Canada. These funds were primarily allocated toward green investments and support for low-income households.

Carbon Pricing Initiatives By Country

The U.S. is currently the only country in North America without a national carbon pricing initiative. Both Canada and Mexico, on the other hand, have implemented federal ETS and carbon tax programs.

Beyond federal initiatives, many regions on the continent have also implemented or are considering their own carbon pricing initiatives. These subnational initiatives are listed in the table below:

| Region | Carbon Pricing Initiative | Status |

|---|---|---|

| 🇨🇦 Alberta, Canada | ETS | Implemented, 2007 |

| 🇨🇦 British Columbia, Canada | Carbon tax and ETS | Implemented, 2008 and 2016 |

| 🇨🇦 Manitoba, Canada | Carbon tax and ETS | Under Consideration |

| 🇨🇦 New Brunswick, Canada | Carbon tax and ETS | Implemented, 2020 and 2021 |

| 🇨🇦 Newfoundland and Labrador, Canada | Carbon tax and ETS | Implemented, both 2019 |

| 🇨🇦 Northwest Territories, Canada | Carbon tax | Implemented, 2019 |

| 🇨🇦 Nova Scotia, Canada | ETS | Implemented, 2019 |

| 🇨🇦 Ontario, Canada | ETS | Implemented, 2022 |

| 🇨🇦 Prince Edward Island, Canada | Carbon tax | Implemented, 2019 |

| 🇨🇦 Quebec, Canada | ETS | Implemented, 2013 |

| 🇨🇦 Saskatchewan, Canada | ETS | Implemented, 2019 |

| 🇺🇸 California, U.S.A. | ETS | Implemented, 2012 |

| 🇺🇸 Hawaii, U.S.A. | Carbon tax | Under Consideration |

| 🇺🇸 Massachusetts, U.S.A. | ETS | Implemented, 2018 |

| 🇺🇸 New York, U.S.A. | ETS | Under Consideration |

| 🇺🇸 North Carolina, U.S.A. | ETS | Under Consideration |

| 🇺🇸 Oregon, U.S.A. | ETS | Implemented, 2021 |

| 🇺🇸 Pennsylvania, U.S.A. | ETS | Under Consideration |

| 🇺🇸 Regional Greenhouse Gas Initiative (RGGI)* | ETS | Implemented, 2009 |

| 🇺🇸 Washington, U.S.A. | ETS | Implemented, 2023 |

| 🇲🇽 Durango, Mexico | Carbon tax | Implemented, 2023 |

| 🇲🇽 Guanajuato, Mexico | Carbon tax | Scheduled, 2023 |

| 🇲🇽 Jalisco, Mexico | Carbon tax | Under Consideration |

| 🇲🇽 Queretaro, Mexico | Carbon tax | Implemented, 2022 |

| 🇲🇽 State of Mexico, Mexico | Carbon tax | Implemented, 2022 |

| 🇲🇽 Yucatan, Mexico | Carbon tax | Implemented, 2022 |

| 🇲🇽 Zacatecas, Mexico | Carbon tax | Implemented, 2017 |

The RGGI was the first mandatory ETS initiative in the U.S. and applies to power plants in Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia.

Since its inception, emissions in the RGGI region fell by more than 50%—twice as fast as the nation as a whole—and raised nearly $6 billion to invest in local communities.

Are All Carbon Pricing Initiatives Created Equal?

In the landscape of carbon pricing initiatives, one critical factor stands out—the price of carbon itself.

According to The High-Level Commission on Carbon Prices, achieving alignment between carbon pricing strategies and the Paris Agreement temperature target requires a price of US$40–80/tCO2 by 2020 and US$50–100/tCO2 by 2030.

Unfortunately, many North American initiatives fall short of these prices, especially in the U.S. and Mexico, where carbon prices reach as low as US$12/tCO2e. Conversely, most Canadian initiatives set a price of US$48/tCO2e.

It’s also important to note that the broader impact of these initiatives depends on a multitude of other factors, including the industries they cover, their flexibility in accommodating changing economic conditions, and the manner in which generated revenue is invested back into sustainable practices.

Within the balance of these various elements lies the potential to steer all industries—including the power sector—toward the necessary emissions reductions.

Learn more about how electric utilities and the power sector can lead on the path toward decarbonization here.

Decarbonization

Unpacking Hydrogen’s Role in Decarbonizing the Electricity Sector

In this infographic, we discuss three ways hydrogen can support the decarbonization of the global electricity sector.

Hydrogen’s Role in Decarbonizing the Electricity Sector

Hydrogen constitutes 75% of the elemental mass in our universe.

According to the International Energy Agency (IEA), it could also play a pivotal role in global decarbonization efforts.

This infographic, created in partnership with the National Public Utilities Council, explores three ways this element could support the decarbonization of the global electricity sector.

Hydrogen 101

First, let’s get a few basics about hydrogen out of the way.

While abundant in nature, hydrogen is rarely found in its elemental state (H2) on Earth, meaning that it needs to be separated from other chemical compounds, such as water (H2O). Once extracted, however, it becomes a versatile and energy-dense fuel source, containing approximately three times the energy content of gasoline or natural gas.

There are several methods to extract hydrogen from compounds. Depending on the production method and energy source, the resulting hydrogen is often categorized by color to show its emission impact.

| Color | Hydrogen Production Method | Energy Source |

|---|---|---|

| Black | Gasification | Coal or Lignite |

| Gray | Steam Methane Reforming (SMR) | Natural Gas |

| Blue | SMR + Carbon Capture and Storage (CCS) | Natural Gas |

| Purple* | Electrolysis | Nuclear Energy |

| Green | Electrolysis | Renewable Energy |

*Purple hydrogen is also referred to as red or pink hydrogen.

Today, black, gray, and blue hydrogen are used in emission-heavy industries such as petroleum refining and ammonia production.

The technology and infrastructure for purple and green hydrogen, on the other hand, are still taking shape. As they progress, these emission-free sources of hydrogen are expected to play a pivotal role in decarbonizing many hard-to-abate sectors, including power.

Three Ways Green Hydrogen Can Help Decarbonize

Now that we’ve covered hydrogen basics, let’s dive into where emission-free hydrogen can fit in the race to decarbonize our global electricity system.

#1: Hydrogen and Natural Gas Blending

Hydrogen can be blended with natural gas in existing pipeline infrastructure for lower-emission power generation.

According to Jenbacher, a 20–30% hydrogen volume can lead to a 7–11% decrease in CO2 emissions, compared to natural gas on its own.

In 2022, U.S. electricity from natural gas generated 743 million metric tons in the United States. A 9% reduction in emissions through hydrogen blending lowers emissions by 67 million metric tons CO2, all without the need to build new infrastructure.

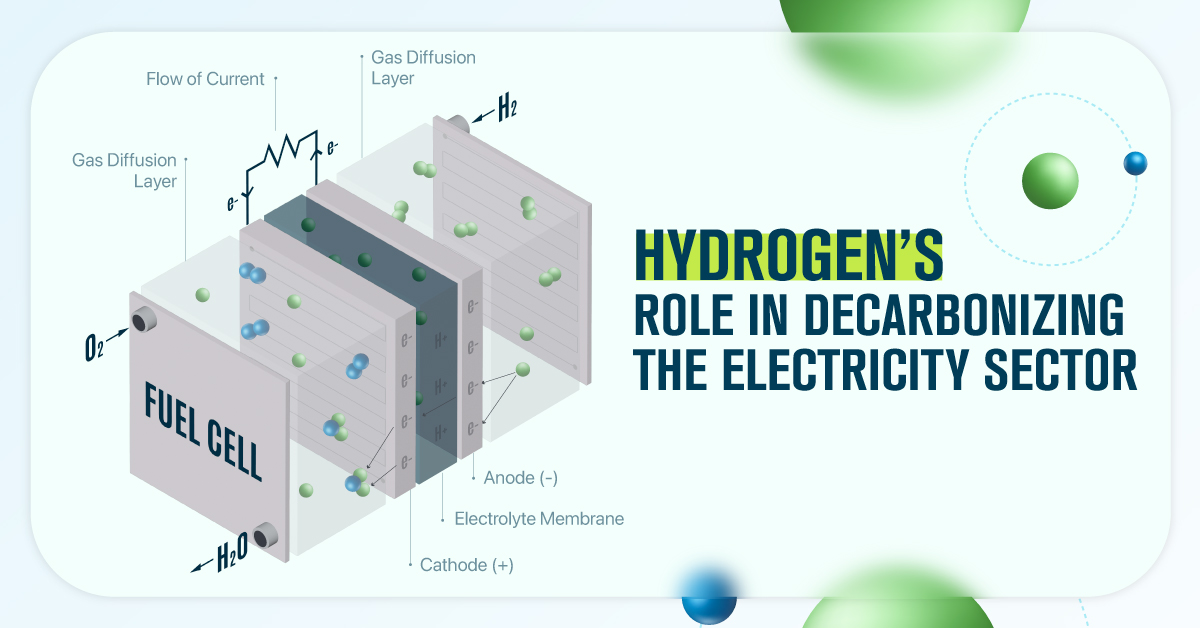

#2: Fuel Cells

A fuel cell generates electricity through an electrochemical reaction between hydrogen and oxygen, with water as the only byproduct.

By using green or pink hydrogen, fuel cells can provide 100% emission-free electricity that is also efficient, reliable, and dispatchable.

#3: Energy Storage

Energy storage plays a pivotal role in decarbonizing the power sector by balancing the intermittent nature of renewables.

While other technologies, such as lithium-ion batteries, can also provide energy storage, hydrogen has a greater potential to offer both large-scale and long-term storage, up to several months at a time.

As technology advances, the IEA predicts that global underground hydrogen capacity will grow by more than 200,000% in the next 30 years, reaching 1,200 TWh in 2050. That amount of energy can power 70,000 U.S. homes for an entire year, underscoring the untapped potential that lies within hydrogen.

Learn how the National Public Utilities Council is working towards the future of sustainable electricity.

Climate

Mapped: Global Temperature Rise by Country (2022-2100P)

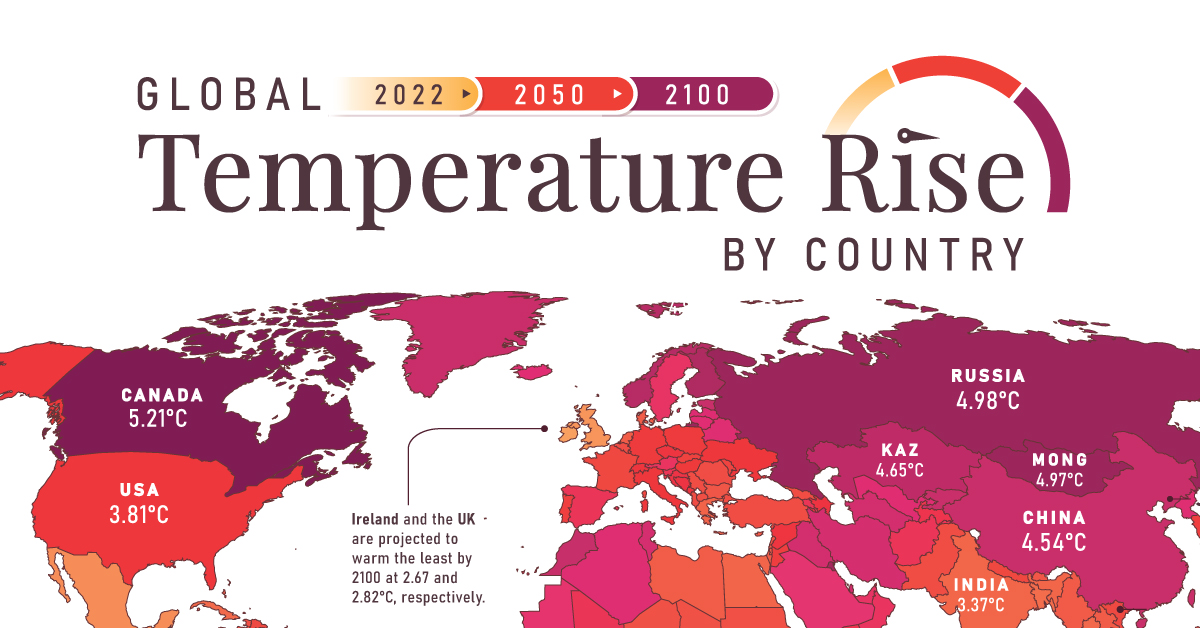

In this set of three maps, we show the global temperature rise on a national level for 2022, 2050, and 2100 based on an analysis by Berkeley Earth.

Mapped: Global Temperature Rise by Country (2022-2100P)

Many scientific authorities, such as the Intergovernmental Panel on Climate Change (IPCC), often discuss the need to limit planetary warming to 2°C above pre-industrial levels.

But did you know that this warming will not be evenly distributed throughout the globe due to factors such as geography, weather patterns, ocean currents, and the influence of human activities?

To discover the current and projected nuances of this uneven warming, these three maps created in partnership with the National Public Utilities Council visualize the global temperature rise by country, using new and updated data from Berkeley Earth.

Current State of Warming

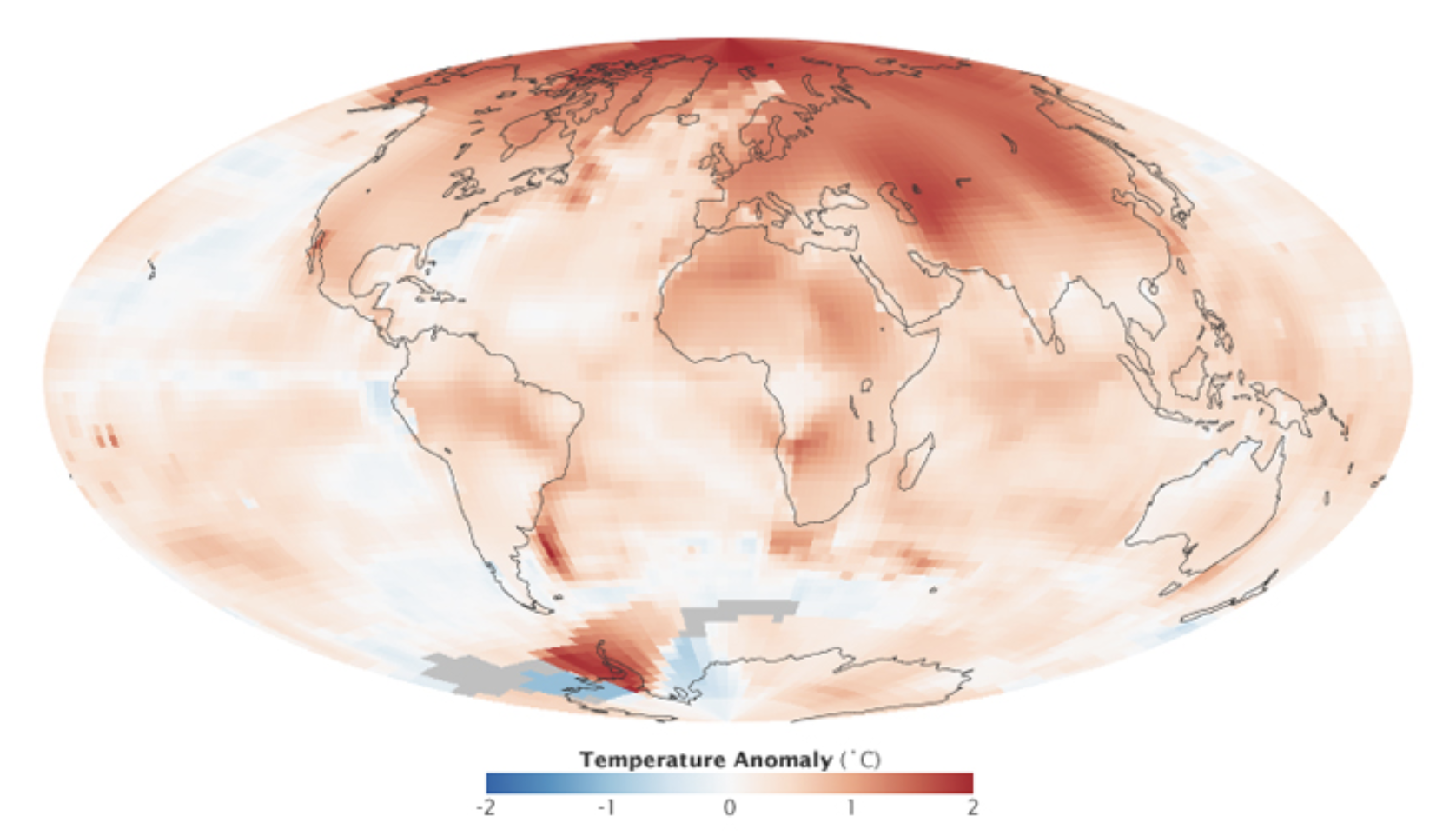

The three maps above visualize warming relative to each country’s average 1850-1900 temperatures.

Looking at warming in 2022, we see that average national warming (i.e. warming excluding oceans) is already 1.81°C above those numbers, with Mongolia warming the most (2.54°C) and Bangladesh warming the least (1.1°C).

As the map depicts, warming is generally more accelerated in the Global North. One of the reasons for this is Arctic amplification.

Arctic amplification refers to the disproportionate heating experienced in the Arctic compared to the rest of the planet. This amplification is fueled by multiple feedback loops, including decreased albedo as ice cover diminishes, leading to further absorption of heat and exacerbating the warming effect.

Arctic amplification. Source: NASA

Aside from modern-day observations, the effects of Arctic amplification are also clearly seen in climate models, where accelerated warming in countries such as Russia and Canada is seen through 2100.

Projected Warming in 2050 and 2100

Moving over to the second and third maps in the slides above, we discover country-level 2050 and 2100 warming projections.

These projections are based on the IPCC’s “middle-of-the-road” scenario, titled Shared Socioeconomic Pathway (SSP) 2-4.5. Out of the various established pathways, this one is the closest to expected emissions under current policies.

2050 Projections

Under the SSP2-4.5 scenario, average national warming is projected to be 2.75°C above average 1850-1900 temperatures in 2050. This includes Mongolia, with the most substantial warming of 3.76°C, and New Zealand, with the mildest warming of 2.02°C.

To put those temperatures into context, here are the risks that would likely accompany them, according to the IPCC’s latest assessment report.

- Extreme weather events will be more frequent and intense, including heavy precipitation and related flooding and cyclones.

- Nearly all ecosystems will face high risks of biodiversity loss, including terrestrial, freshwater, coastal and marine ecosystems.

- Accelerated sea level rise will threaten coastal cities, leading to mass displacement.

Let’s now take a look at 2100 projections, which would have significantly higher levels of risk unless fast and extreme mitigation and adaptation measures are implemented in the upcoming decades.

2100 Projections

2100 projections under the SSP2-4.5 scenario depict an average national warming of 3.80°C.

More than 55 countries across the globe are projected to have warming above 4°C in comparison to their 1850-1900 averages, and nearly 100 above 3.5°C.

Here is what those levels of warming would likely mean, according to the IPCC.

- 3-39% of terrestrial species will face very high risks of extinction.

- Water scarcity will considerably affect cities, farms, and hydro plants, and about 10% of the world’s land area will experience rises in both exceptionally high and exceptionally low river flows.

- Droughts, floods, and heatwaves will pose substantial threats to global food production and accessibility, eroding food security and impacting nutritional stability on a significant scale.

Generally, warming at this level is expected to pose substantial catastrophic risks to humanity, necessitating swift and bold climate action.

Learn more about how electric utilities and the power sector can lead on the path toward decarbonization here.

-

Energy Shift9 months ago

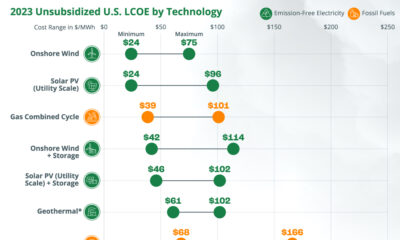

Energy Shift9 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

Electrification1 year ago

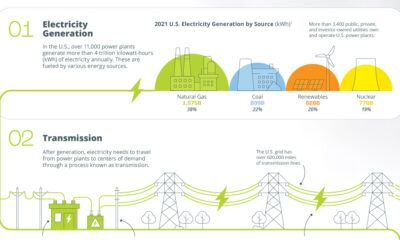

Electrification1 year agoVisualized: How the Power Grid Works

-

Energy Shift1 year ago

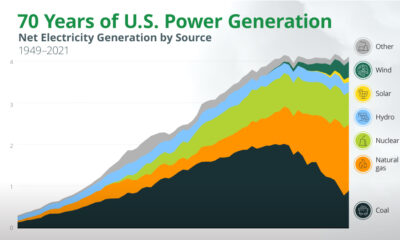

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

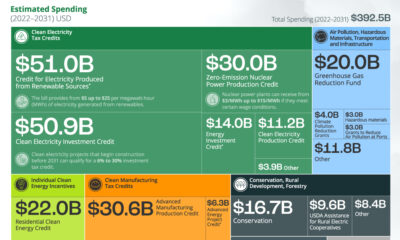

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Emissions1 year ago

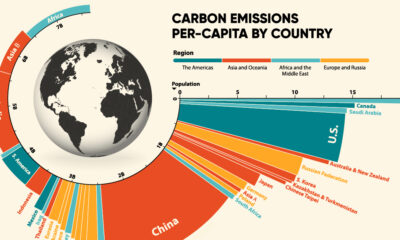

Emissions1 year agoVisualizing Global Per Capita CO2 Emissions

-

Clean Energy1 year ago

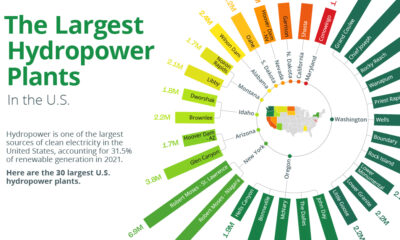

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

Decarbonization1 year ago

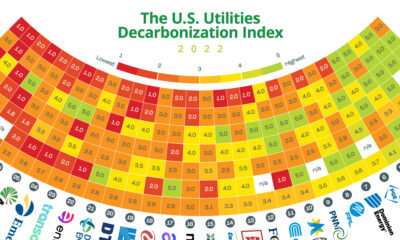

Decarbonization1 year agoThe U.S. Utilities Decarbonization Index

-

Clean Energy7 months ago

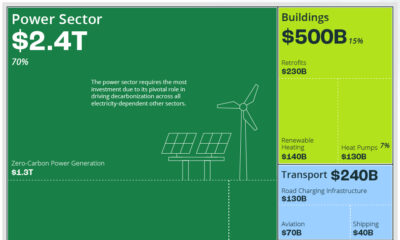

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition