Clean Energy

Visualizing Clean Energy and Emissions Goals by State

The following content is sponsored by the National Public Utilities Council

Visualized: Clean Energy and Emissions Goals by State

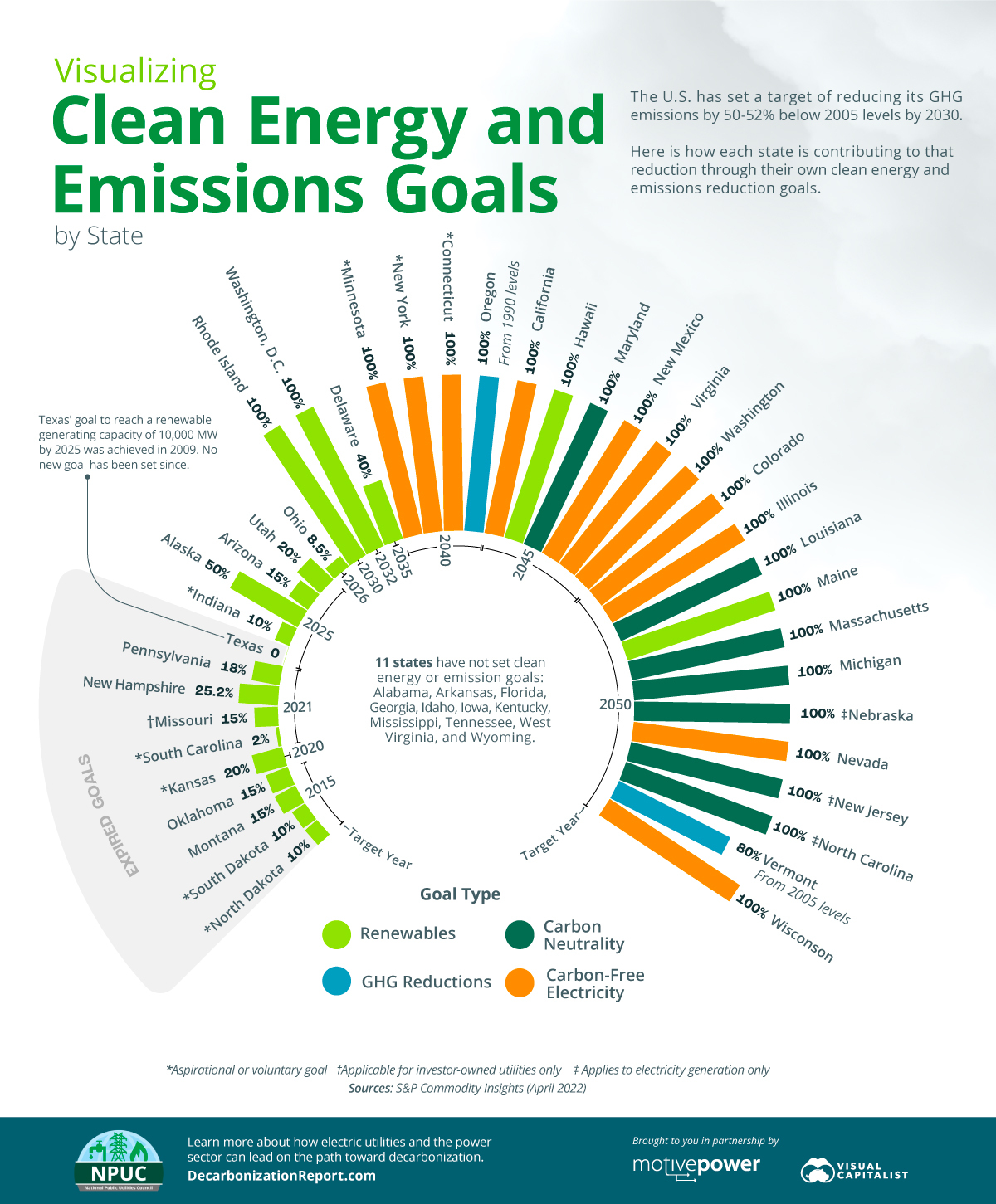

In its Nationally Determined Contribution to the Paris Agreement, the U.S. set a target of reducing its greenhouse gas (GHG) emissions by 50-52% below 2005 levels by 2030, as well as achieving 100% carbon-free electricity by 2035.

To discover how each state is contributing to these goals, this graphic sponsored by the National Public Utilities Council provides an overview of each state’s ultimate clean energy or GHG emission reduction goal.

Varying Commitments

An analysis of the aggregated data by S&P Commodity Insights reveals a broad spectrum of clean energy and emission reduction goals in the United States.

While some states have more ambitious goals of attaining 100% clean energy by 2040, others, such as Ohio, have opted for more modest and short-term targets, aiming to achieve 8.5% renewable electricity by 2026.

Eleven states, or 22%, have never set clean energy or emission reduction goals. These states include Alabama, Florida, Georgia, Mississippi, Tennessee, and West Virginia.

Similarly, another ten states (20%) have expired goals with target dates as far back as 2015. These ten states, including the Dakotas, Missouri, Kansas, Montana, and Oklahoma, have not reset their goals since.

Shares of Clean Energy by State

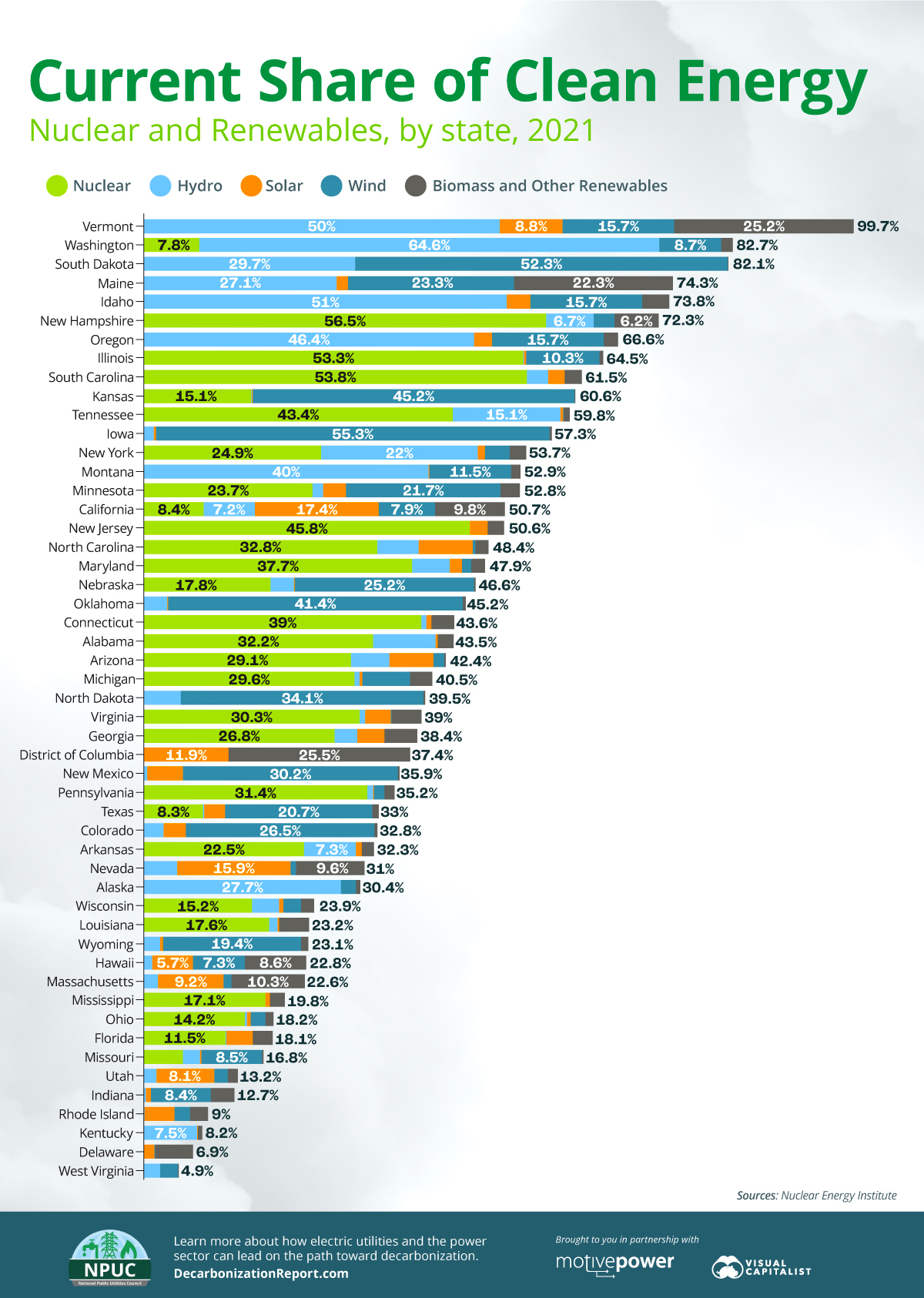

To get a glimpse into how far each state has to go in achieving its goal, a snapshot of the use of clean electricity in each state is shown below.

Using data from the Nuclear Energy Insitute, the bars show each state’s 2021 share of emission-free electricity broken down by nuclear and various renewables.

While clean electricity made up 70% or more of the electricity mix in several states, nuclear and renewable energy sources comprised approximately 40% of total U.S. electricity generation in 2021.

To hit its 100% carbon-free electricity goal, therefore, the U.S. needs a minimum 4.3% annual increase in clean electricity generation through 2035. For context, an average annual growth of 2.4% was observed in the last five years.

On the GHG reduction side of things, emissions were 17% below 2005 levels in 2021, showing the need for an additional 35% reduction by 2030.

As these figures show, achieving the ambitious clean energy and emissions reduction goals in the U.S. will require a significant ramp-up of clean electricity generation in the upcoming years, along with accelerated decarbonization efforts across all sectors.

Clean Energy

Visualized: The Four Benefits of Small Modular Reactors

What advantages do small modular reactors offer compared to their traditional counterparts?

Visualized: The Four Benefits of Small Modular Reactors

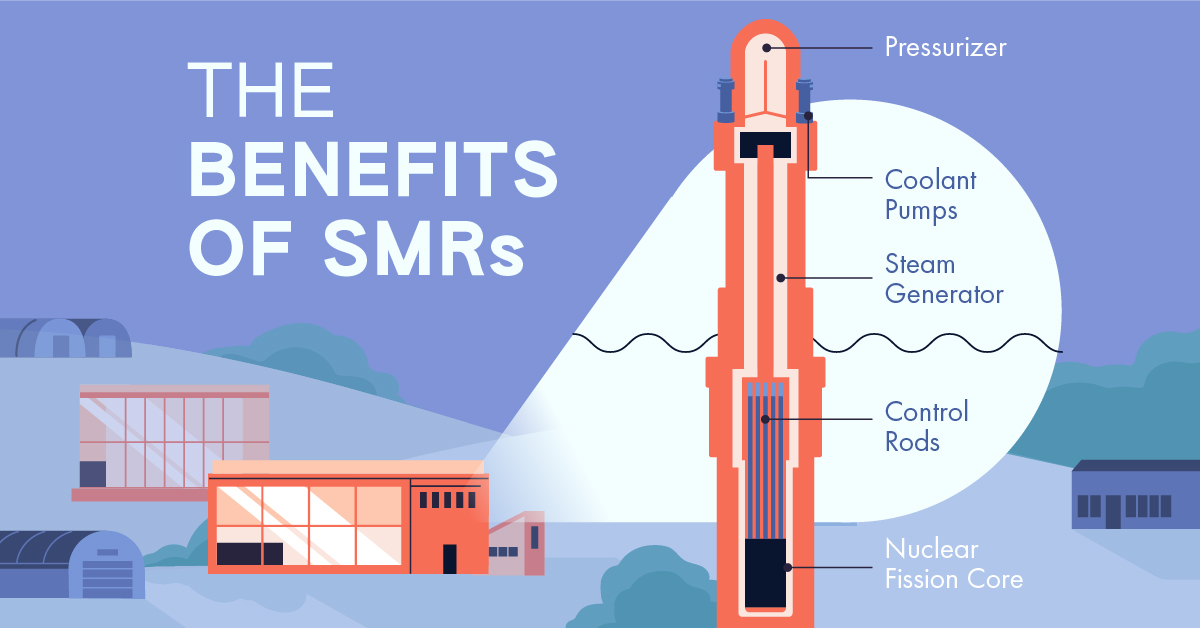

Nuclear power has a crucial role to play on the path to net zero. Traditional nuclear plants, however, can be costly, resource-intensive, and take up to 12 years to come online.

Small modular reactors (SMR) offer a possible solution.

Created in partnership with the National Public Utilities Council, this infographic explores some of the benefits SMRs can offer their traditional counterparts. Let’s dive in.

The Four Key Benefits of SMRs, Explained

An SMR is a compact nuclear reactor that is typically less than 300 megawatts electric (MWe) in capacity and manufactured in modular units.

Here are some of the benefits they offer.

#1: Lower Costs

SMRs require a lower upfront capital investment due to their compact size.

SMRs can also match the per-unit electricity costs of traditional reactors due to various economic efficiencies related to their modular design, including design simplification, factory fabrication, and potential for regulatory harmonization.

#2: Quicker Deployment

Traditional nuclear plants can take up to 12 years to become operational. This is primarily due to their site-specific designs and substantial on-site labor involved in construction.

SMRs, on the other hand, are largely manufactured in factories and are location-independent, which minimizes on-site labor and expedites deployment timelines to as little as three years. This means they can be deployed relatively quickly to provide emissions-free electricity to the grid, supporting growing electricity needs.

#3: Siting Flexibility and Land Efficiency

SMRs have greater siting flexibility compared to traditional reactors due to their smaller size and modular design. In addition, they can utilize land more effectively than traditional reactors, yielding a higher output of electrical energy per unit of land area.

| Rolls-Royce SMR, UK (Proposed) | Median-Sized U.S. Nuclear Plant | |

|---|---|---|

| Capacity | 470 MW | 1,000 MW |

| Area Requirement | 10 Acres* | 832 Acres |

| Land/Space Efficiency | 47 MW/Acre | 1.2 MW/Acre |

*Estimated area requirement

Given their flexibility, SMRs are also suitable for installation on decommissioned coal power plant sites, which can support the transition to clean electricity while utilizing existing transmission infrastructure.

#4: Safety

SMRs have simpler designs, use passive cooling systems, and require lower power and operating pressure, making them inherently safer to operate than traditional reactors.

They also have different refueling needs compared to traditional plants, needing refueling every 3–7 years instead of the 1–2 years typical for large plants. This minimizes the transportation and handling of nuclear fuel, mitigating the risk of accidents.

The Road Ahead

As of early 2024, only five SMRs are operating worldwide. But with several other projects under construction and nearly 20 more in advanced stages of development, SMRs hold promise for expanding global emission-free electricity capacity.

With that said, certain obstacles remain for the wide-scale adoption of SMRs in the United States, which was particularly apparent in the 2023 cancellation of the NuScale SMR project.

To fully realize the benefits of SMRs and advance decarbonization efforts, a focus on financial viability, market readiness, and broader utility and public support may be essential.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

Clean Energy

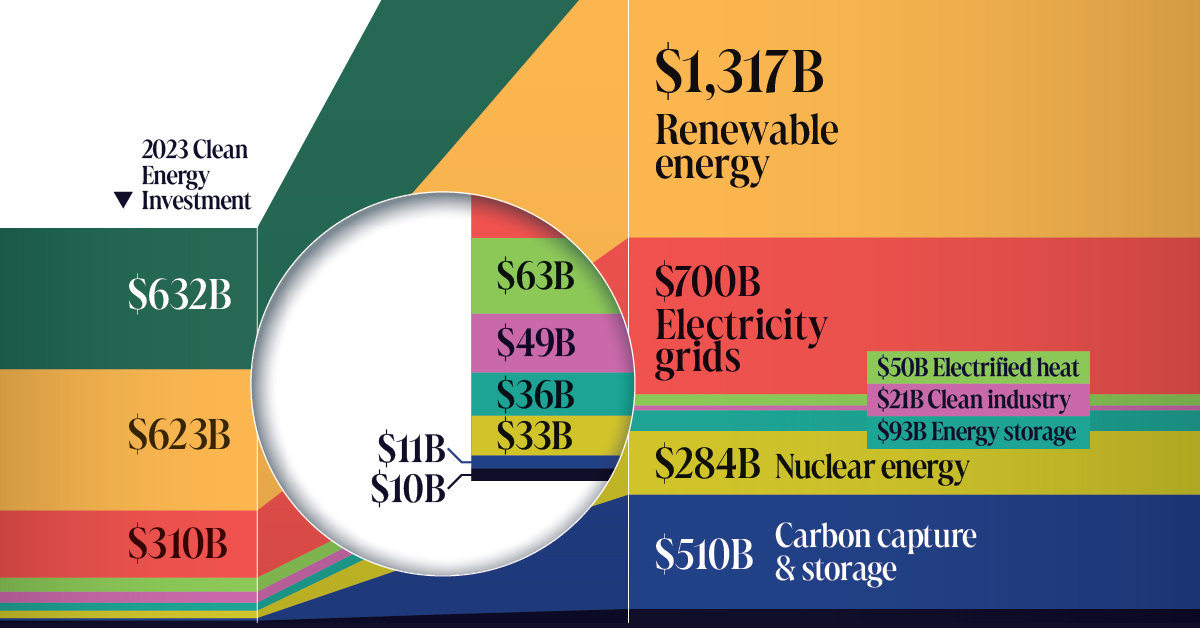

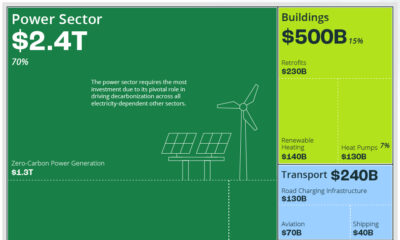

The $3 Trillion Clean Energy Investment Gap, Visualized

In this graphic, we explore the $3 trillion clean energy investment gap visualized by sector, according to BloombergNEF data.

The $3 Trillion Clean Energy Investment Gap, Visualized

Global investment in the clean energy transition grew by 17% in 2023, showing resilience despite geopolitical tensions, high interest rates, and inflation.

But was it enough to keep the world on track to hit net zero by 2050?

To answer this question, we compare 2023 clean energy investment by sector with what’s annually needed to reach net zero by 2050, in partnership with the National Public Utilities Council.

The Investment Gap, By Sector

According to BloombergNEF data, annual global investment in the energy transition is at an all-time high. Despite this, only the electrified heat and clean industry sectors are meeting the thresholds necessary to hit net zero by 2050.

| 2023 Investment | Required Annual Investment for Net Zero*, 2024–2030 | Investment Gap | |

|---|---|---|---|

| Electrified transport | $632B | $1,805B | $1,173B |

| Renewable energy | $623B | $1,317B | $694B |

| Electricity grids | $310B | $700B | $390B |

| Electrified heat | $63B | $50B | -$13B |

| Clean industry | $49B | $21B | -$28B |

| Energy storage | $36B | $93B | $57B |

| Nuclear energy | $33B | $284B | $251B |

| Carbon capture and storage (CCS) | $11B | $510B | $499B |

| Hydrogen | $10B | $62B | $52B |

| TOTAL | $1,767B | $4,842B | $3,075B |

*BloombergNEF’s Net-Zero 2050 Scenario

To stay on track for net zero by 2050, the yearly investments in electrified transport, renewable energy, power grids, and energy storage must more than double their current rates for the rest of the decade.

Hydrogen, nuclear, and carbon capture and storage (CCS) have an even steeper hill to climb and must grow 6, 9, and 46 fold, respectively.

The Path Forward

It’s important to note that despite the current annual investment gap of $3T, the clean energy industry continues to exhibit positive trends.

Investment in electrified transport, for instance, surpassed that in renewable energy for the first time in 2023, marking a win for the sector.

Emerging sectors also experienced robust expansion despite being furthest off-target. Investments in hydrogen tripled to $10B, CCS nearly doubled to $11B, and energy storage witnessed a 76% increase to reach $36B in 2023.

These encouraging developments underscore the industry’s potential to drive transformative change and pave the way for a more sustainable and resilient energy landscape in the years ahead.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

-

Electrification1 year ago

Electrification1 year agoVisualized: How the Power Grid Works

-

Energy Shift9 months ago

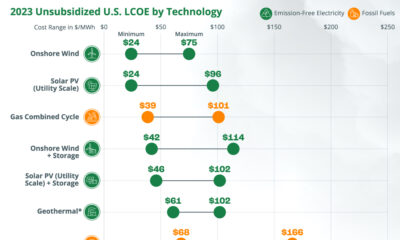

Energy Shift9 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

Energy Shift1 year ago

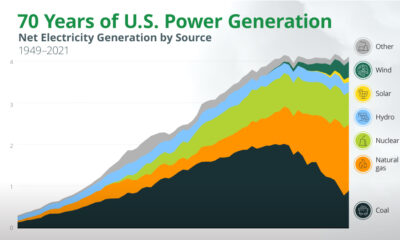

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

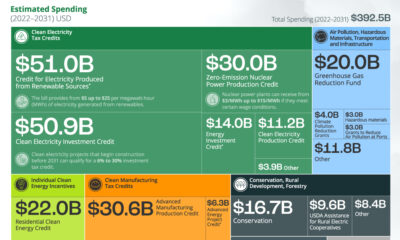

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Emissions1 year ago

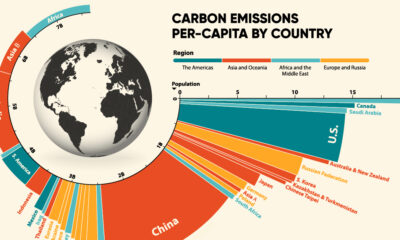

Emissions1 year agoVisualizing Global Per Capita CO2 Emissions

-

Decarbonization1 year ago

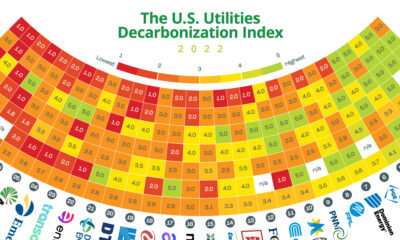

Decarbonization1 year agoThe U.S. Utilities Decarbonization Index

-

Clean Energy1 year ago

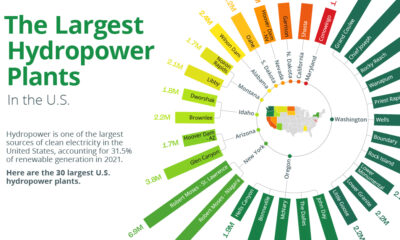

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

Clean Energy7 months ago

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition