Clean Energy

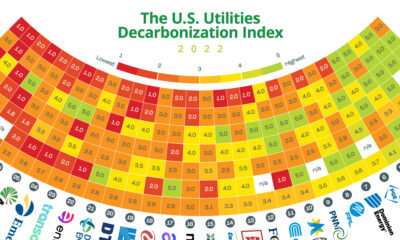

Ranked: Which U.S. Utilities Have The Cleanest Electricity Generation?

Which Utilities Have The Cleanest Electricity Generation?

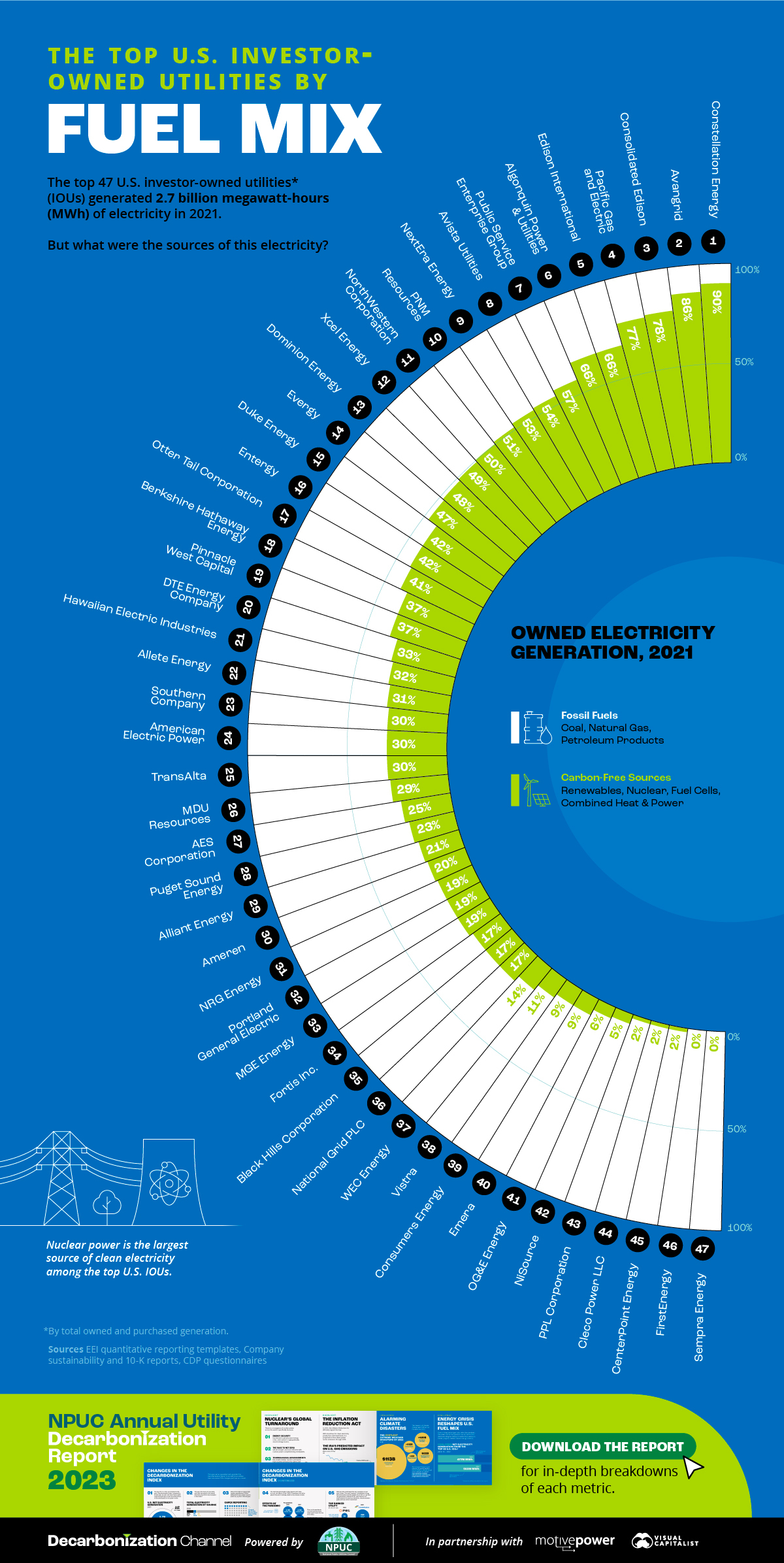

For the second year, Visual Capitalist and our sponsor National Public Utilities Council have developed the Annual Utility Decarbonization Index. The index quantifies and compares the status of decarbonization among the 47 largest investor-owned utilities (IOUs) in the United States, ranking them on six metrics based on publicly available 2021 data.

- Metric 1: Fuel Mix

- Metric 2: CO2 Emissions Intensity

- Metric 3: Total CO2 Emissions

- Metric 4: CO2 Emissions per Customer

- Metric 5: Decarbonization Goals

- Metric 6: Low-Carbon Investment

The graphic above gives a preview of the first metric’s results, which ranks U.S. utilities by the share of low-carbon sources in their owned electricity generations.

Let’s now dive into the included IOUs and their rankings.

Which Utilities Are Included In the Decarbonization Index?

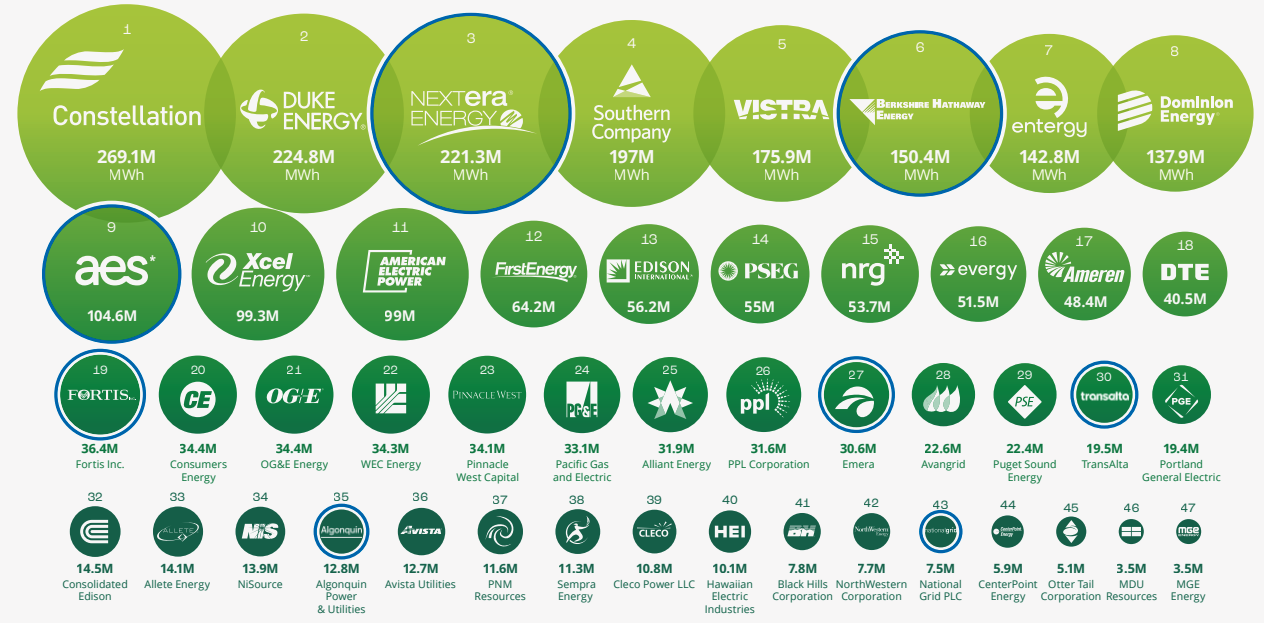

The IOUs that were ranked in this year’s Utility Decarbonization Index are the 47 largest U.S. IOUs by their 2021 net owned and purchased electricity generations, which are as follows.

U.S. IOUs that had fewer than 2 million megawatt-hours (MWh) of owned generation were excluded from the report. Companies with blue outlines, on the other hand, represent those that have international operations in addition to their operations in the United States.

Which U.S. Utilities Had the Cleanest Generation in 2021?

The top 47 U.S. IOUs outlined above generated 2.7 billion MWh of electricity and served 68% of all U.S. electric customers in 2021.

Collectively, 60% of this generation came from fossil fuels such as natural gas and coal, whereas the remaining 40% came from carbon-free energy sources, such as nuclear, wind, and solar.

But each utility’s fuel mix looked very different across the board. Let’s see which ones had the cleanest owned generation.

| Company | Share of Carbon-Free Sources (Renewables, Nuclear, Fuel Cells, Combined Heat & Power) | Share of Fossil Fuels (Coal, Petroleum, Natural Gas, Petroleum Coke) |

|---|---|---|

| Constellation Energy (Exelon) | 90% | 10% |

| Avangrid | 86% | 14% |

| Consolidated Edison | 78% | 22% |

| Pacific Gas and Electric | 77% | 23% |

| Edison International (EIX) | 66% | 34% |

| Algonquin Power & Utilities | 66% | 34% |

| Public Service Enterprise Group | 57% | 43% |

| Avista Utilities | 54% | 46% |

| NextEra Energy | 53% | 47% |

| PNM Resources | 51% | 49% |

| NorthWestern Corporation | 50% | 50% |

| Xcel Energy | 49% | 51% |

| Dominion Energy | 48% | 52% |

| Evergy | 47% | 53% |

| Duke Energy | 42% | 58% |

| Entergy | 42% | 58% |

| Otter Tail Corporation | 41% | 59% |

| Berkshire Hathaway Energy | 37% | 63% |

| Pinnacle West Capital | 37% | 63% |

| DTE Energy Company | 33% | 67% |

| Hawaiian Electric Industries | 32% | 68% |

| Allette Energy | 31% | 69% |

| Southern Company | 30% | 70% |

| American Electric Power | 30% | 70% |

| TransAlta | 30% | 70% |

| MDU Resources | 29% | 71% |

| AES Corporation | 25% | 75% |

| Puget Sound Energy (PSE) | 23% | 77% |

| Alliant Energy | 21% | 79% |

| Ameren | 20% | 80% |

| NRG Energy | 19% | 81% |

| Portland General Electric | 19% | 81% |

| MGE Energy | 19% | 81% |

| Fortis Inc. | 17% | 83% |

| Black Hills Corporation | 17% | 83% |

| National Grid PLC | 17% | 83% |

| WEC Energy | 14% | 86% |

| Vistra | 11% | 89% |

| Consumers Energy | 9% | 91% |

| Emera | 9% | 91% |

| OG&E Energy | 6% | 94% |

| NiSource | 5% | 95% |

| PPL Corporation | 2% | 98% |

| Cleco Power LLC | 2% | 98% |

| CenterPoint Energy | 2% | 98% |

| FirstEnergy | 0% | 100% |

| Sempra Energy | 0% | 100% |

Overall, nuclear power was the single largest source of clean electricity among these utility companies in 2021. Conversely, 17 IOUs used fossil fuels for more than 80% of their owned electricity generation, and some as high as 100%.

Download The 2023 Annual Utility Decarbonization Report

The 2023 Annual Utility Decarbonization Report is a deep dive into the state of decarbonization across the investor-owned utility sector in the United States.

What else does the report include?

- The full Annual Utility Decarbonization Index 2023 with data breakdowns for each of the six metrics

- ESG Report Card 2023

- Sector highlights and challenges in 2021-22

- Six Reasons for Decarbonizing Utilities

- Decarbonization Strategies for U.S. Utilities

Clean Energy

Visualized: The Four Benefits of Small Modular Reactors

What advantages do small modular reactors offer compared to their traditional counterparts?

Visualized: The Four Benefits of Small Modular Reactors

Nuclear power has a crucial role to play on the path to net zero. Traditional nuclear plants, however, can be costly, resource-intensive, and take up to 12 years to come online.

Small modular reactors (SMR) offer a possible solution.

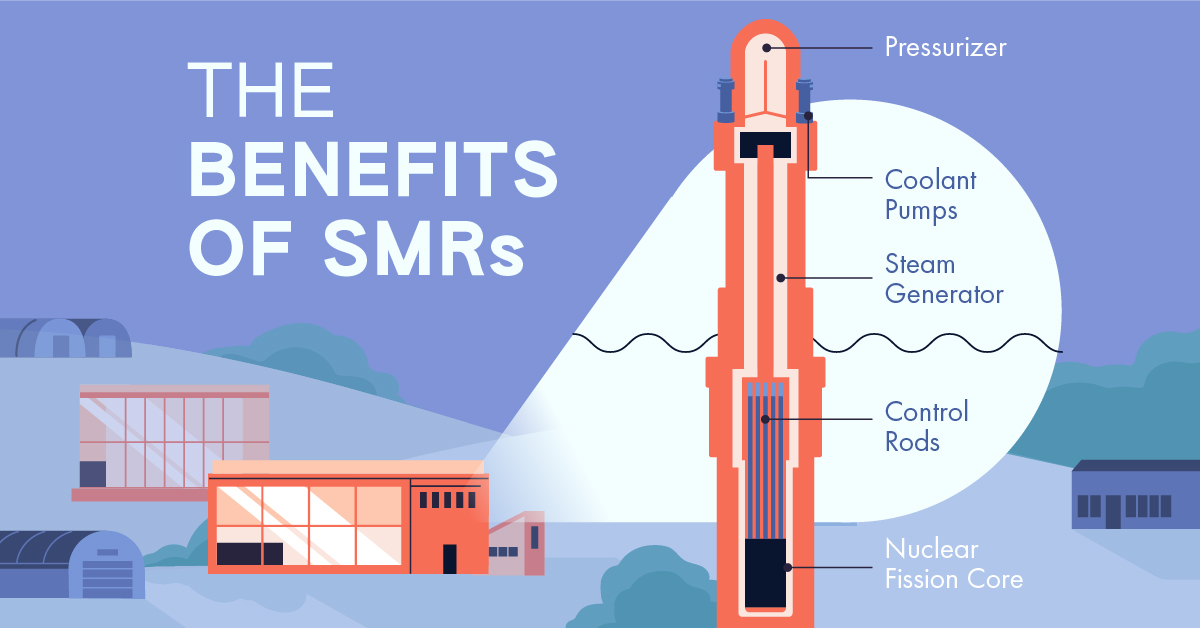

Created in partnership with the National Public Utilities Council, this infographic explores some of the benefits SMRs can offer their traditional counterparts. Let’s dive in.

The Four Key Benefits of SMRs, Explained

An SMR is a compact nuclear reactor that is typically less than 300 megawatts electric (MWe) in capacity and manufactured in modular units.

Here are some of the benefits they offer.

#1: Lower Costs

SMRs require a lower upfront capital investment due to their compact size.

SMRs can also match the per-unit electricity costs of traditional reactors due to various economic efficiencies related to their modular design, including design simplification, factory fabrication, and potential for regulatory harmonization.

#2: Quicker Deployment

Traditional nuclear plants can take up to 12 years to become operational. This is primarily due to their site-specific designs and substantial on-site labor involved in construction.

SMRs, on the other hand, are largely manufactured in factories and are location-independent, which minimizes on-site labor and expedites deployment timelines to as little as three years. This means they can be deployed relatively quickly to provide emissions-free electricity to the grid, supporting growing electricity needs.

#3: Siting Flexibility and Land Efficiency

SMRs have greater siting flexibility compared to traditional reactors due to their smaller size and modular design. In addition, they can utilize land more effectively than traditional reactors, yielding a higher output of electrical energy per unit of land area.

| Rolls-Royce SMR, UK (Proposed) | Median-Sized U.S. Nuclear Plant | |

|---|---|---|

| Capacity | 470 MW | 1,000 MW |

| Area Requirement | 10 Acres* | 832 Acres |

| Land/Space Efficiency | 47 MW/Acre | 1.2 MW/Acre |

*Estimated area requirement

Given their flexibility, SMRs are also suitable for installation on decommissioned coal power plant sites, which can support the transition to clean electricity while utilizing existing transmission infrastructure.

#4: Safety

SMRs have simpler designs, use passive cooling systems, and require lower power and operating pressure, making them inherently safer to operate than traditional reactors.

They also have different refueling needs compared to traditional plants, needing refueling every 3–7 years instead of the 1–2 years typical for large plants. This minimizes the transportation and handling of nuclear fuel, mitigating the risk of accidents.

The Road Ahead

As of early 2024, only five SMRs are operating worldwide. But with several other projects under construction and nearly 20 more in advanced stages of development, SMRs hold promise for expanding global emission-free electricity capacity.

With that said, certain obstacles remain for the wide-scale adoption of SMRs in the United States, which was particularly apparent in the 2023 cancellation of the NuScale SMR project.

To fully realize the benefits of SMRs and advance decarbonization efforts, a focus on financial viability, market readiness, and broader utility and public support may be essential.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

Clean Energy

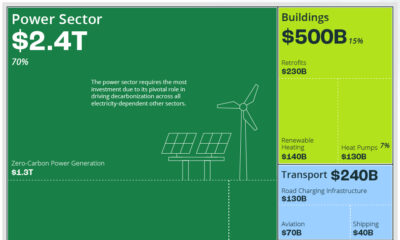

The $3 Trillion Clean Energy Investment Gap, Visualized

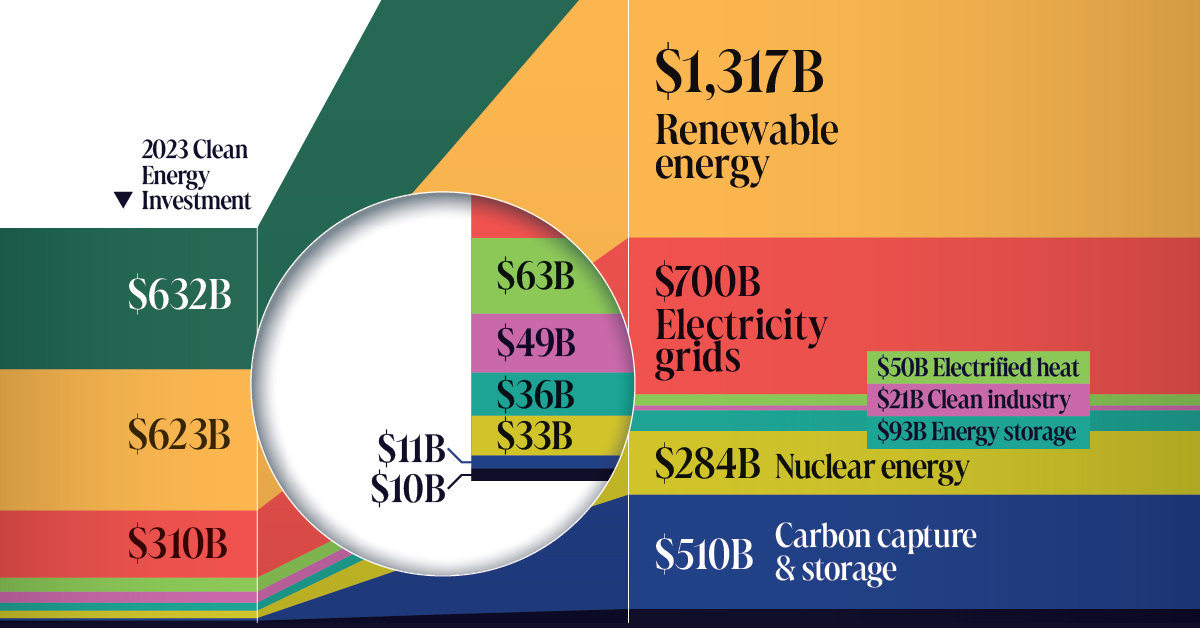

In this graphic, we explore the $3 trillion clean energy investment gap visualized by sector, according to BloombergNEF data.

The $3 Trillion Clean Energy Investment Gap, Visualized

Global investment in the clean energy transition grew by 17% in 2023, showing resilience despite geopolitical tensions, high interest rates, and inflation.

But was it enough to keep the world on track to hit net zero by 2050?

To answer this question, we compare 2023 clean energy investment by sector with what’s annually needed to reach net zero by 2050, in partnership with the National Public Utilities Council.

The Investment Gap, By Sector

According to BloombergNEF data, annual global investment in the energy transition is at an all-time high. Despite this, only the electrified heat and clean industry sectors are meeting the thresholds necessary to hit net zero by 2050.

| 2023 Investment | Required Annual Investment for Net Zero*, 2024–2030 | Investment Gap | |

|---|---|---|---|

| Electrified transport | $632B | $1,805B | $1,173B |

| Renewable energy | $623B | $1,317B | $694B |

| Electricity grids | $310B | $700B | $390B |

| Electrified heat | $63B | $50B | -$13B |

| Clean industry | $49B | $21B | -$28B |

| Energy storage | $36B | $93B | $57B |

| Nuclear energy | $33B | $284B | $251B |

| Carbon capture and storage (CCS) | $11B | $510B | $499B |

| Hydrogen | $10B | $62B | $52B |

| TOTAL | $1,767B | $4,842B | $3,075B |

*BloombergNEF’s Net-Zero 2050 Scenario

To stay on track for net zero by 2050, the yearly investments in electrified transport, renewable energy, power grids, and energy storage must more than double their current rates for the rest of the decade.

Hydrogen, nuclear, and carbon capture and storage (CCS) have an even steeper hill to climb and must grow 6, 9, and 46 fold, respectively.

The Path Forward

It’s important to note that despite the current annual investment gap of $3T, the clean energy industry continues to exhibit positive trends.

Investment in electrified transport, for instance, surpassed that in renewable energy for the first time in 2023, marking a win for the sector.

Emerging sectors also experienced robust expansion despite being furthest off-target. Investments in hydrogen tripled to $10B, CCS nearly doubled to $11B, and energy storage witnessed a 76% increase to reach $36B in 2023.

These encouraging developments underscore the industry’s potential to drive transformative change and pave the way for a more sustainable and resilient energy landscape in the years ahead.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

-

Electrification1 year ago

Electrification1 year agoVisualized: How the Power Grid Works

-

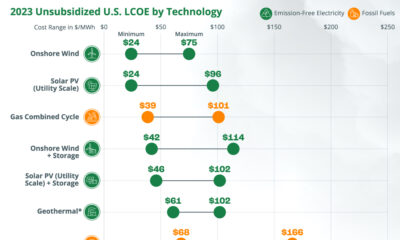

Energy Shift9 months ago

Energy Shift9 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

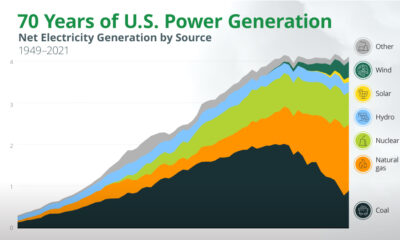

Energy Shift1 year ago

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

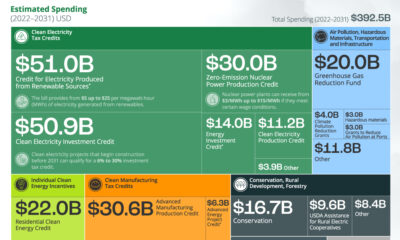

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Emissions1 year ago

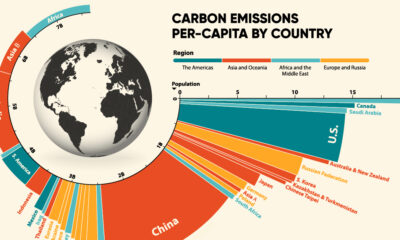

Emissions1 year agoVisualizing Global Per Capita CO2 Emissions

-

Decarbonization1 year ago

Decarbonization1 year agoThe U.S. Utilities Decarbonization Index

-

Clean Energy1 year ago

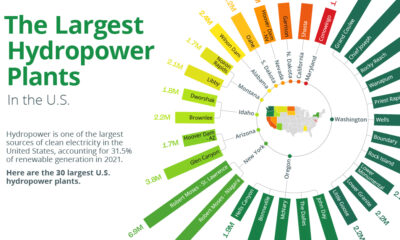

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

Clean Energy7 months ago

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition