Energy Shift

Road to Decarbonization: U.S. Coal Plant Closures

The following content is sponsored by the National Public Utilities Council

Road to Decarbonization: U.S. Coal Plant Closures

This was originally posted on August 17, 2021, on Visual Capitalist.

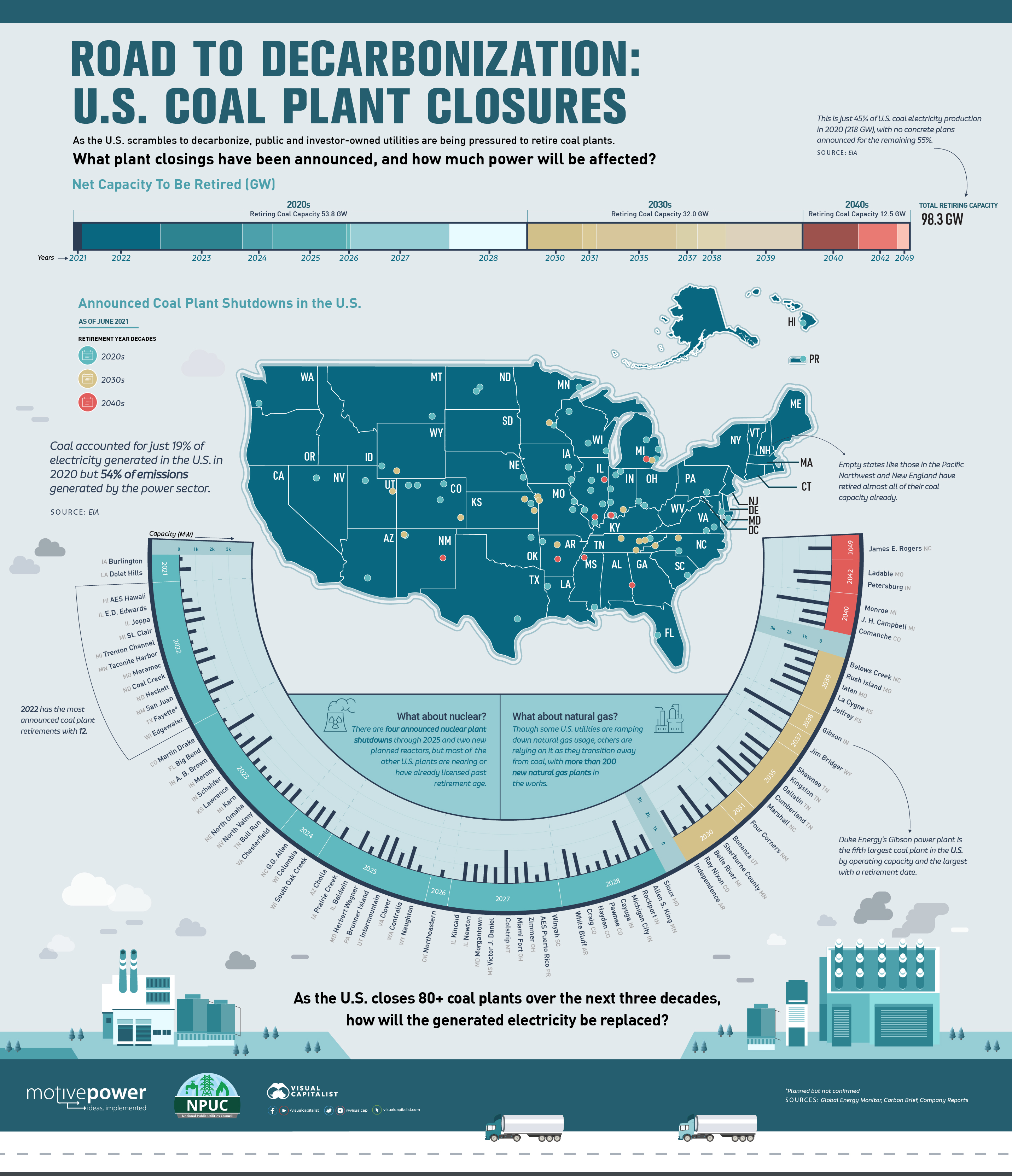

As the push to decarbonize starts to kick into gear in the U.S., how do coal plant closures factor into the equation?

With a target of net-zero emissions by 2050, the U.S. is examining all aspects of its economy to see where action is needed. In the automotive industry, for example, the Biden administration is aiming for half of new vehicles to be electric by 2030, following in the footsteps of automakers that have made similar commitments.

But in the power sector that supplies electricity for much of the country, fossil fuels continue to be large emission sources. Coal, which accounted for just 19% of electricity generated in the U.S. in 2020, created 54% of the power sector’s emissions.

That’s leading to U.S. utilities feeling the pressure to retire coal plants and look for alternatives. This infographic from the National Public Utilities Council visualizes the coal plant closures that have been announced, and how much power will be affected as a result.

Where Are U.S. Coal Plant Closures Happening?

Accurately tracking coal plant closures currently means turning to non-profits and parsing through company reports. To assemble this list, we leveraged the Global Energy Monitor and Carbon Brief and cross-referenced against company sustainability reports and news releases.

The result? 80 coal plants with a total capacity of 98.3 GW publicly scheduled for full retirement over the next three decades.

| Plant | State | Retirement Date | Capacity (MW) |

|---|---|---|---|

| Burlington | IA | 2021 | 212 |

| Dolet Hills | LA | 2021 | 721 |

| AES Hawaii | HI | 2022 | 204 |

| Coal Creek | ND | 2022 | 1,210 |

| E.D. Edwards | IL | 2022 | 645 |

| Edgewater | WI | 2022 | 414 |

| Fayette* (announced not confirmed) | TX | 2022 | 1,690 |

| Heskett | ND | 2022 | 115 |

| Joppa | IL | 2022 | 1,100 |

| Meramec | MO | 2022 | 924 |

| San Juan | NM | 2022 | 924 |

| St. Clair | MI | 2022 | 1,210 |

| Taconite Harbor | MN | 2022 | 168 |

| Trenton Channel | MI | 2022 | 536 |

| A.B. Brown | IN | 2023 | 530 |

| Big Bend | FL | 2023 | 1,824 |

| Bull Run | TN | 2023 | 950 |

| Chesterfield | VA | 2023 | 1,053 |

| Karn | MI | 2023 | 516 |

| Lawrence | KS | 2023 | 517 |

| Martin Drake | CO | 2023 | 207 |

| Merom | IN | 2023 | 1,080 |

| North Omaha | NE | 2023 | 354 |

| North Valmy | NV | 2023 | 567 |

| Schahfer | IN | 2023 | 1,944 |

| Columbia | WI | 2024 | 1,112 |

| G.G. Allen | NC | 2024 | 1,155 |

| South Oak Creek | WI | 2024 | 1,240 |

| Baldwin | IL | 2025 | 1,260 |

| Brunner Island | PA | 2025 | 1,558 |

| Centralia | WA | 2025 | 1,460 |

| Cholla | AZ | 2025 | 840 |

| Clover | VA | 2025 | 848 |

| Herbert Wagner | MD | 2025 | 495 |

| Intermountain | UT | 2025 | 1,640 |

| Nauhgton | WY | 2025 | 448 |

| Prairie Creek | IA | 2025 | 50 |

| Northeastern | OK | 2026 | 473 |

| AES Puerto Rico | PR | 2027 | 510 |

| Colstrip | MT | 2027 | 2,272 |

| Kincaid | IL | 2027 | 1,319 |

| Miami Fort | OH | 2027 | 1,115 |

| Morgantown | MD | 2027 | 1,252 |

| Newton | IL | 2027 | 1,235 |

| Victor J. Daniel | MS | 2027 | 1,097 |

| Winyah | SC | 2027 | 1,260 |

| Zimmer | OH | 2027 | 1,426 |

| Allen S. King | MN | 2028 | 598 |

| Cayuga | IN | 2028 | 1,062 |

| Craig | CO | 2028 | 1,427 |

| Hayden | CO | 2028 | 466 |

| Michigan City | IN | 2028 | 540 |

| Pawnee | CO | 2028 | 552 |

| Rockport | IN | 2028 | 2,600 |

| Sioux | MO | 2028 | 1,099 |

| White Bluff | AR | 2028 | 1,800 |

| Belle River | MI | 2030 | 1,396 |

| Bonanza | UT | 2030 | 500 |

| Independence | AR | 2030 | 1,800 |

| Ray Nixon | CO | 2030 | 207 |

| Sherburne County | MN | 2030 | 2,469 |

| Four Corners | NM | 2031 | 1,636 |

| Cumberland | TN | 2035 | 2,600 |

| Gallatin | TN | 2035 | 1,255 |

| Kingston | TN | 2035 | 1,700 |

| Marshall | NC | 2035 | 1,996 |

| Shawnee | TN | 2035 | 1,750 |

| Jim Bridger | WY | 2037 | 2,441 |

| Gibson | IN | 2038 | 3,340 |

| Belews Creek | NC | 2039 | 2,160 |

| Iatan | MO | 2039 | 1,725 |

| Jeffrey | KS | 2039 | 2,160 |

| La Cygne | KS | 2039 | 1,599 |

| Rush Island | MO | 2039 | 1,242 |

| Comanche | CO | 2040 | 1,636 |

| J. H. Campbell | MI | 2040 | 1,540 |

| Monroe | MI | 2040 | 3,280 |

| Ladabie | MO | 2042 | 2,389 |

| Petersburg | IN | 2042 | 2,147 |

| James E. Rogers | NC | 2049 | 1,481 |

Noticeably, most of the coal plant closures are targeted in the Midwest (which uses the most coal for power). And most of the retirements are coming early, with the 2020s seeing more than half of announced closures and retired capacity (53.6 GW).

But the largest coal plants with announced retirement dates are currently scheduled for the 2030s and 2040s. That includes Duke Energy’s Gibson power plant in Indiana, the fifth largest coal plant in the U.S. and the largest with a retirement date.

What’s Next for U.S. Decarbonization?

Though it seems like the U.S. has a lot of coal plant closures announced, there’s a lot left to go.

The 98.3 GW of tracked coal plant closures is just 45% of U.S. coal electricity production in 2020. Though many utilities have talked about eventually assessing and planning retirements for some of the remaining 55%, no concrete plans have been announced yet.

“In our industry, deciding to exit coal-fired power is not taken lightly,” said Omaya Ahmad, Sustainability Policy Consultant at Arizona Public Service. “Our coal plants are often the oldest in our fleet and are largely the reason our service territories have grown and flourished into what they are today. However, the pressures presented by climate change and the economic demands tied to coal have required a commitment to transition to clean energy.”

Coal Plant Closures Are Part of a Larger Equation

But as Ahmad explains, turning off coal plants is not such a quick-and-easy fix.

“Such a transition will be a lofty undertaking and will not come without its own challenges,” said Ahmad. “Recognizing the regional transition landscape and timeline depicted on a map like this one will help utilities adequately prepare for and support their coal communities as we all take steps to reach a clean energy economy.”

And coal plants are just one part of the decarbonization equation. Some utilities are opting to transform coal power plants into natural gas plants, which are more cost-efficient and emit less than coal. Even though many utilities and consumers are turning away from carbon emitting fuel sources entirely, there are more than 200 new natural gas plants planned in the U.S.

But the big question is how the generated electricity from coal will be replaced. Communities that rely on coal for power (and economic strength) will have to turn to natural gas or work on renewables capacity, while others have already started the transition.

National Public Utilities Council is the go-to resource for all things decarbonization in the utilities industry. Learn more.

Energy Shift

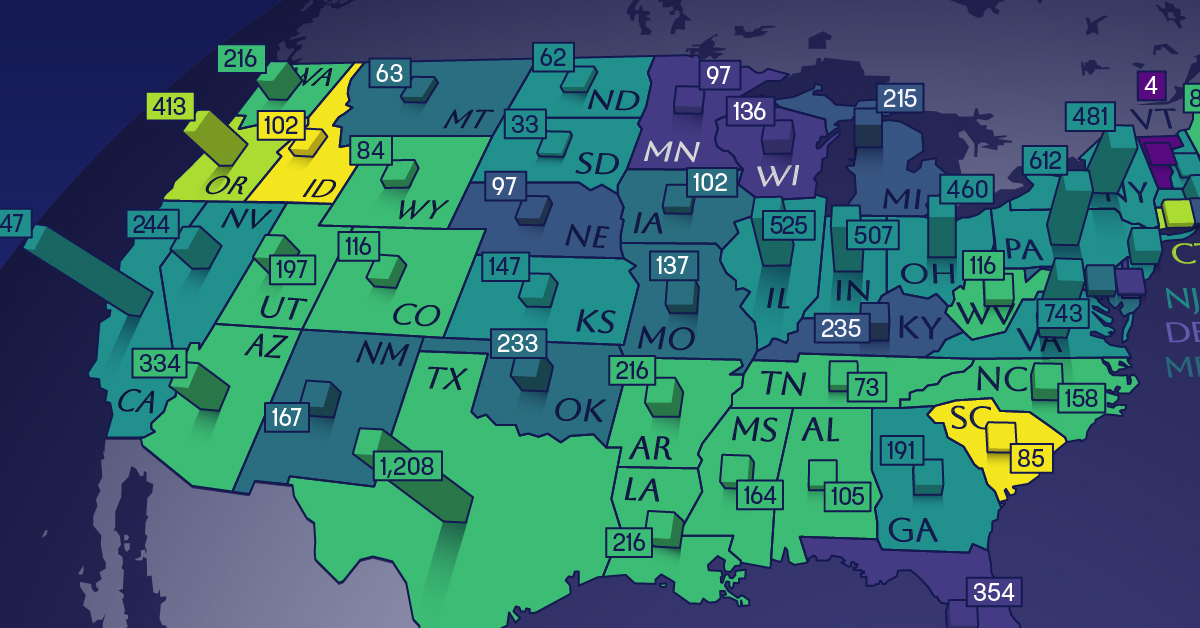

Mapped: The Age of Energy Projects in Interconnection Queues, by State

This map shows how many energy projects are in interconnection queues by state and how long these projects have been queued up, on average.

U.S. Energy Projects in Interconnection Queues, by State

By the end of 2023, more than 11,000 energy projects were in interconnection queues in the United States, waiting for a green-light from regional grid operators to proceed with construction.

This map, sponsored by the National Public Utilities Council, maps out the average age of active energy projects in interconnection queues by state, using data from Berkeley Lab.

Interconnection Queues, Explained

Interconnection queues are lists of energy projects that have made interconnection requests to their regional grid operators. Once submitted, these requests formally initiate the impact study process that each project goes through before grid connection, forming waiting lists for approval known as interconnection queues.

In recent years, both the number and generation capacity of queued projects have surged in the United States, along with the length of time spent in queue.

According to Berkeley Lab, the amount of generation capacity entering queues each year has risen by more than 550% from 2015 to 2023, with average queue duration rising from 3 years to 5 years the same period.

As a result of the growing backlog, a large proportion of projects ultimately withdraw from queues, leading to only 19% of applications reaching commercial operations.

The Backlog: Number of Projects and Average Wait Times

Of the 11,000 active projects in U.S. queues at the end of 2023, Texas, California, and Virginia had the most in queue; 1,208, 947, and 743, respectively.

When looking at the average ages of these projects, all three states hovered around the national average of 34 months (2.83 years), with Texas sporting 28 months, California 33, and Virginia 34.

Vermont, Minnesota, Wisconsin, and Florida, on the other hand, had the highest average queue durations; 54, 49, 47, and 46 months, respectively.

Average Queue Duration by Project Type

At the end of 2023, more than 95% of the generation capacity in active interconnection queues was for emission-free resources. The table below provides a breakdown.

| Project Type | Average Queue Duration (As of 12/31/2023) | Number of Projects in Queue |

|---|---|---|

| Wind | 40 months | 841 |

| Solar | 34 months | 4,506 |

| Wind+Battery | 34 months | 76 |

| Solar+Battery | 27 months | 2,377 |

| Battery | 24 months | 2,818 |

Wind projects had the highest wait times at the end of 2023 with an average age of 40 months (3.33 years). Solar projects, on the other hand, made up more than 40% of projects in queue.

Overall, reducing the time that these renewable energy projects spend in queues can accelerate the transition to a low-carbon energy future.

According to the U.S. Department of Energy, enhancing data transparency, streamlining approval processes, promoting economic efficiency, and maintaining a reliable grid are some of the ways this growing backlog can be mitigated.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

Energy Shift

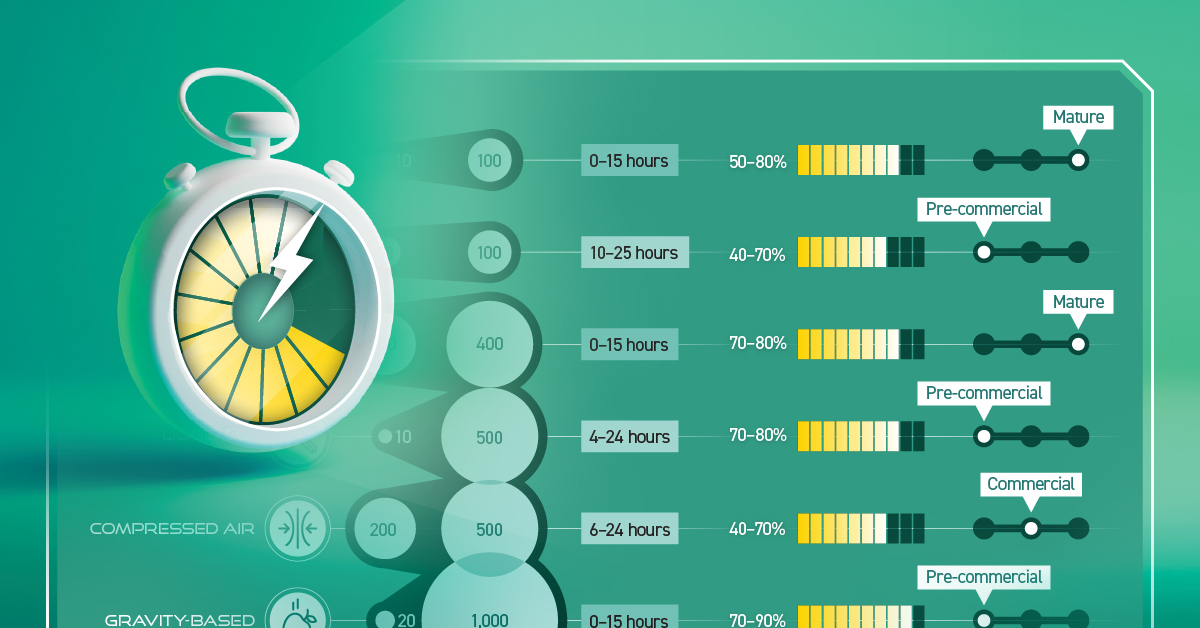

All Commercially Available Long Duration Energy Storage Technologies, in One Chart

In this chart, we break down the parameters of LDES technologies that have commercial or pre-commercial readiness.

All Commercially Available Long Duration Energy Storage Technologies, in One Chart

Long duration energy storage (LDES) technologies can store electricity for 10+ hours, complementing intermittent renewables, boosting grid resiliency, and reducing fossil fuel dependency.

Created in partnership with the National Public Utilities Council, this chart lists the characteristics of LDES technologies that have commercial or pre-commercial readiness, using data from the LDES Council’s Net-Zero Power report and 2023 deployment update.

The Four Primary Types of LDES

Before getting into the details, let’s cover the four primary types of LDES.

- Mechanical: Stores potential energy (by tension or position)

- Thermal: Stores energy as heat

- Chemical: Stores energy found within chemical bonds

- Electrochemical (batteries): Stores energy of chemical reactions, where electrical energy is converted to chemical energy and vice versa

Currently, mechanical storage systems are the most common around the world. Aboveground pumped hydropower, for instance, currently accounts for 96% of all utility-scale energy storage in the United States.

How Do LDES Technologies Measure Up?

Below, we list the storage capacity, storage duration, and average round-trip efficiency (RTE) of LDES technologies that have commercial or pre-commercial readiness on a global scale.

For context, RTE measures the effectiveness of a storage system by measuring the ratio of energy output to energy input during a full charge-discharge cycle. Or briefly, the higher the RTE, the lower the losses and therefore higher the efficiency.

| Form of Energy Storage | LDES Technology | Storage Capacity (MW) | Nominal Duration (Hours) | Average Round-Trip Efficiency |

|---|---|---|---|---|

| Mechanical | Underground pumped hydro | 10–100 | 0–15 | 50–80% |

| Mechanical | Liquid air | 50–100 | 10–25 | 40–70% |

| Mechanical | Aboveground pumped hydro | 200–400 | 0–15 | 70–80% |

| Mechanical | Liquid CO2 | 10–500 | 4–24 | 70–80% |

| Mechanical | Compressed air | 200–500 | 6–24 | 40–70% |

| Mechanical | Gravity-based | 20–1,000 | 0–15 | 70–90% |

| Thermal | Sensible heat | 10–500 | 200 | 55–90% |

| Chemical | Power-to-gas-to-power | 10–100 | 500–1,000 | 40–70% |

| Electrochemical | Aqueous electrolyte flow battery | 10–100 | 25–100 | 50–80% |

| Electrochemical | Metal anode battery | 10–100 | 50–200 | 40–70% |

| Electrochemical | Hybrid flow battery (with liquid electrolyte and metal anode) | >100 | 8–50 | 55–75% |

The table above shows that a mechanical, gravity-based LDES system can provide the highest storage capacity while presenting an impressive 70–90% average RTE.

On the other hand, a chemical power-to-gas-to-power system, which typically converts electricity to hydrogen gas and back to electricity, provides the highest storage duration of up to 1,000 hours.

With that said, there are different storage needs and siting considerations across electrical grids. Given the diverse range of options available, suitable solutions can be found to complement renewables and aid decarbonization.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

-

Energy Shift9 months ago

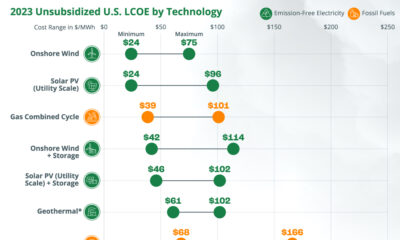

Energy Shift9 months agoRanked: The Cheapest Sources of Electricity in the U.S.

-

Electrification1 year ago

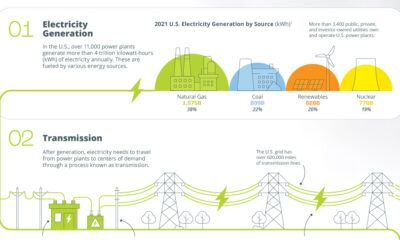

Electrification1 year agoVisualized: How the Power Grid Works

-

Energy Shift1 year ago

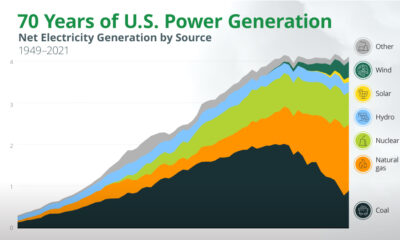

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

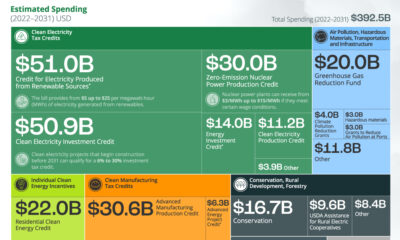

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Clean Energy1 year ago

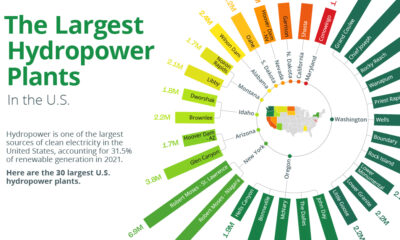

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

Emissions1 year ago

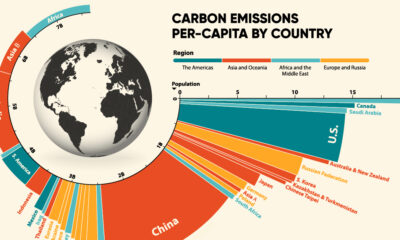

Emissions1 year agoVisualizing Global Per Capita CO2 Emissions

-

Decarbonization1 year ago

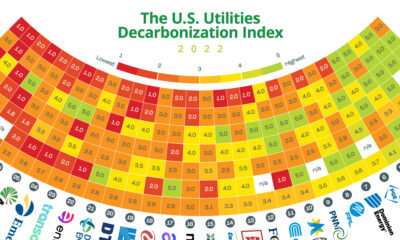

Decarbonization1 year agoThe U.S. Utilities Decarbonization Index

-

Clean Energy7 months ago

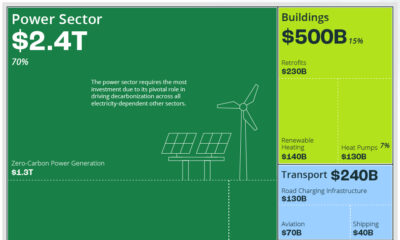

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition