Energy Shift

Ranked: The Cheapest Sources of Electricity in the U.S.

The following content is sponsored by the National Public Utilities Council

Ranked: The Cheapest Sources of Electricity in the U.S.

In 2022, the U.S. electricity sector’s reliance on fossil fuels resulted in a staggering 1,539 million tonnes of CO2 emissions.

With the urgent need to decarbonize, however, the question remains: can the transition from fossil fuels to emission-free electricity sources, such as solar, wind, and nuclear power, be accomplished in a financially viable manner?

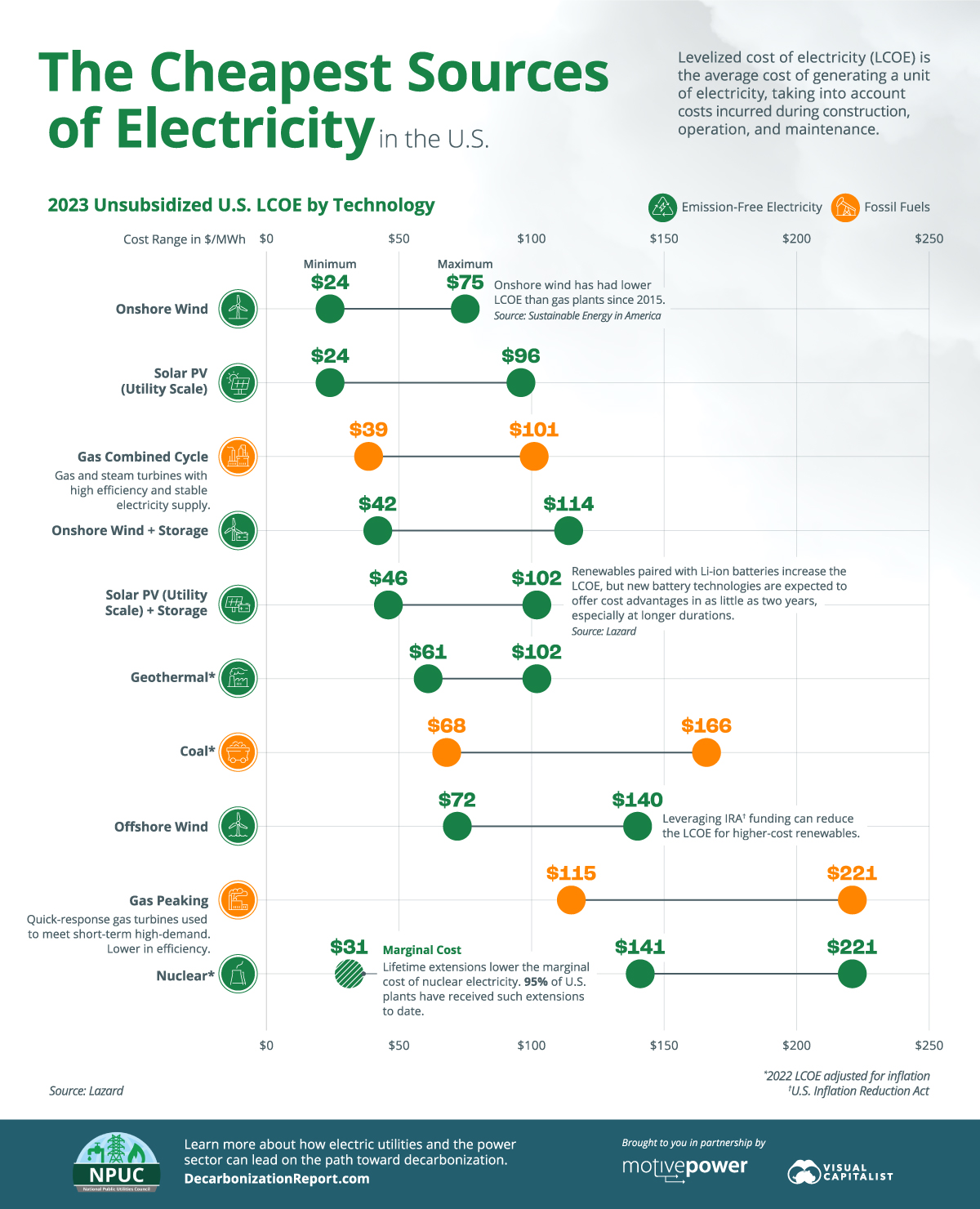

In this graphic sponsored by the National Public Utilities Council, we seek answers to that question by visualizing the 2023 levelized costs of electricity of various technologies in the U.S., as calculated by Lazard.

Understanding Levelized Cost of Electricity

Levelized cost of electricity (LCOE) is a metric used to assess the cost of generating electricity from a specific power source over its lifetime.

The measure takes into account all of the costs associated with building, operating, and maintaining a power plant, as well as the amount of electricity the plant is expected to produce over its lifetime.

LCOE is a comprehensive way to compare the costs of various electricity generation technologies. It’s also worth mentioning, however, that there is a substantial amount of tax subsidies available for clean electricity generation in the U.S., including the $161 billion in clean electricity tax credits in the Inflation Reduction Act (IRA).

By leveraging these funding opportunities, the LCOE of renewables, nuclear power and energy storage systems has the potential to fall even further, bolstering their competitive edge in the market.

Ranking the Cheapest Sources of Electricity

According to Lazard’s 2023 analysis of unsubsidized LCOE in the U.S., both onshore wind and utility-scale solar photovoltaic (PV) technologies are more cost-effective than combined cycle natural gas power plants.

In the case of onshore wind, this has been true since 2015.

| Technology | U.S. Levelized Cost of Electricity, $/MWh, 2023 | |

|---|---|---|

| Minimum | Maximum | |

| Onshore wind | $24 | $75 |

| Solar PV (utility scale) | $24 | $96 |

| Gas combined cycle | $39 | $101 |

| Onshore wind + 4-hour lithium storage | $42 | $114 |

| Solar PV (utility scale) + 4-hour lithium storage | $46 | $102 |

| Geothermal* | $61 | $102 |

| Coal* | $68 | $166 |

| Offshore wind | $72 | $140 |

| Gas peaking | $115 | $221 |

| Nuclear* | $141 | $221 |

*2022 LCOE adjusted for inflation.

Overall, the data shows us that most emission-free sources are cheaper than fossil fuels. There are, however, some other things to consider:

- Coupling lithium-ion batteries with intermittent energy technologies, such as wind and solar, raises costs by $6-$39/MWh. As new storage technologies, such as electrochemical batteries, mature, however, Lazard expects them to offer cost advantages to lithium-ion ones in as little as two years, especially at longer durations (6+ hours).

- While the LCOE of nuclear seems to be high, license renewals can significantly lower the marginal cost of electricity in these power plants. 88 of the 92 U.S. nuclear reactors have received such renewals in the past.

- The efficiency of generation technologies plays a big role in LCOE. This is especially evident in the high cost of gas peaking power plants.

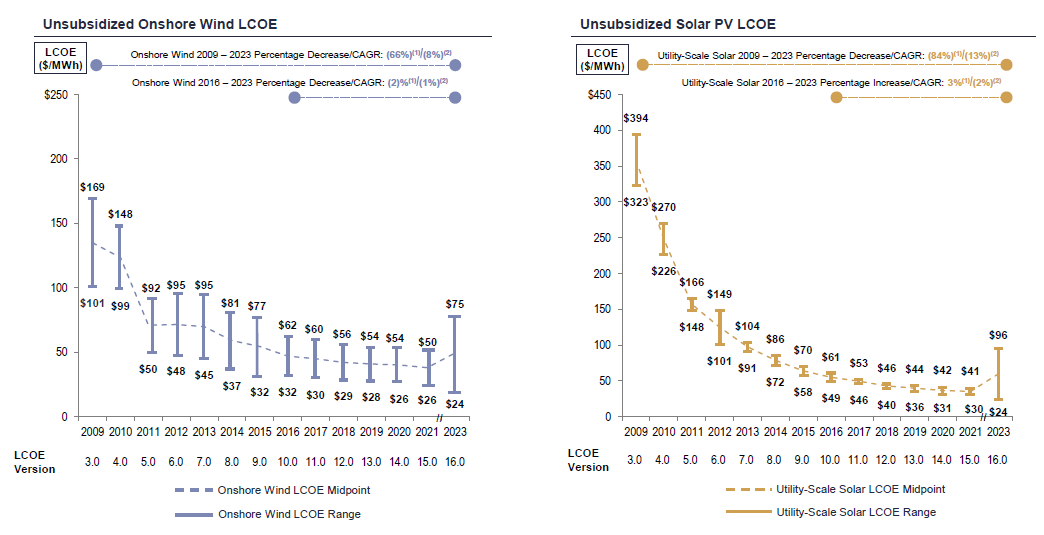

LCOE Trends for Clean Electricity

There are various factors that can influence the LCOE of clean electricity technologies. These include:

- Financing costs, policy incentives, and government subsidies

- Geographical location, which can influence the availability of renewable resources like sunlight and wind speed

- The availability and cost of key clean energy metals and materials, such as copper, silicon, nickel, zinc and chromium

- The maturity of the technologies, the scale of deployment and the growth in demand

- The overall supply chain, including where most of these technologies are primarily manufactured (China), shipping costs, and disruptions due to global events, such as wars

As seen below, the combination of these factors has dramatically pulled down the LCOE of onshore wind and solar PV since 2009, with the exception of 2022-2023.

Source: Lazard

According to the International Energy Agency (IEA), however, most of these cost pressures related to inflation and supply chain challenges are easing in 2023, allowing these technologies to remain cost-competitive in today’s volatile fuel-price environment.

Energy Shift

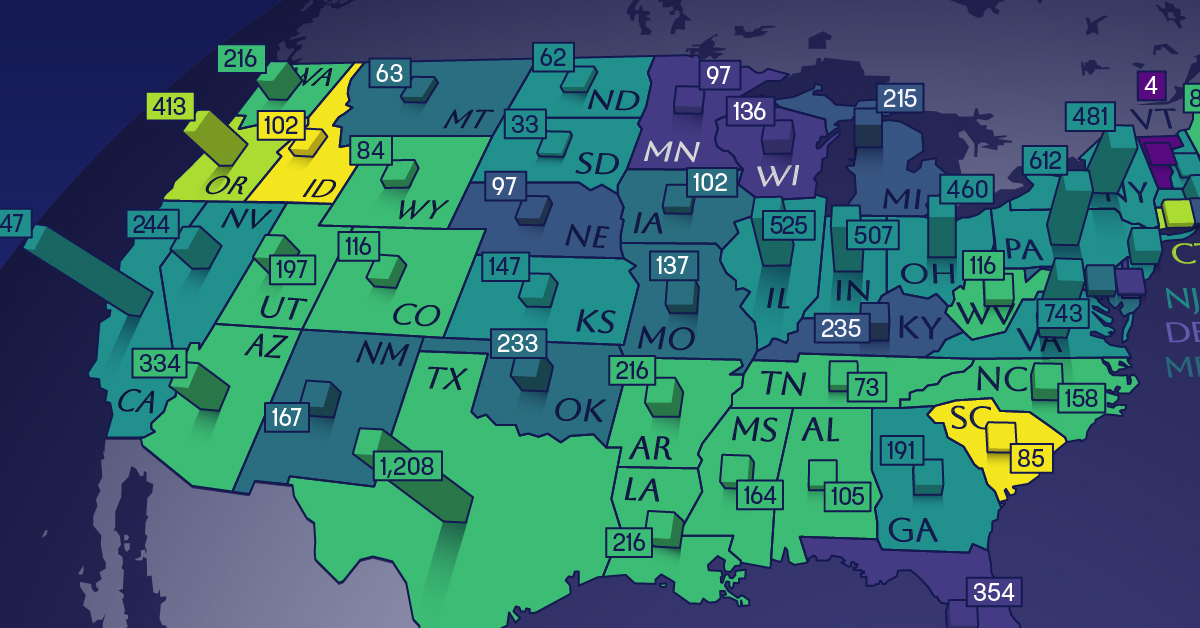

Mapped: The Age of Energy Projects in Interconnection Queues, by State

This map shows how many energy projects are in interconnection queues by state and how long these projects have been queued up, on average.

U.S. Energy Projects in Interconnection Queues, by State

By the end of 2023, more than 11,000 energy projects were in interconnection queues in the United States, waiting for a green-light from regional grid operators to proceed with construction.

This map, sponsored by the National Public Utilities Council, maps out the average age of active energy projects in interconnection queues by state, using data from Berkeley Lab.

Interconnection Queues, Explained

Interconnection queues are lists of energy projects that have made interconnection requests to their regional grid operators. Once submitted, these requests formally initiate the impact study process that each project goes through before grid connection, forming waiting lists for approval known as interconnection queues.

In recent years, both the number and generation capacity of queued projects have surged in the United States, along with the length of time spent in queue.

According to Berkeley Lab, the amount of generation capacity entering queues each year has risen by more than 550% from 2015 to 2023, with average queue duration rising from 3 years to 5 years the same period.

As a result of the growing backlog, a large proportion of projects ultimately withdraw from queues, leading to only 19% of applications reaching commercial operations.

The Backlog: Number of Projects and Average Wait Times

Of the 11,000 active projects in U.S. queues at the end of 2023, Texas, California, and Virginia had the most in queue; 1,208, 947, and 743, respectively.

When looking at the average ages of these projects, all three states hovered around the national average of 34 months (2.83 years), with Texas sporting 28 months, California 33, and Virginia 34.

Vermont, Minnesota, Wisconsin, and Florida, on the other hand, had the highest average queue durations; 54, 49, 47, and 46 months, respectively.

Average Queue Duration by Project Type

At the end of 2023, more than 95% of the generation capacity in active interconnection queues was for emission-free resources. The table below provides a breakdown.

| Project Type | Average Queue Duration (As of 12/31/2023) | Number of Projects in Queue |

|---|---|---|

| Wind | 40 months | 841 |

| Solar | 34 months | 4,506 |

| Wind+Battery | 34 months | 76 |

| Solar+Battery | 27 months | 2,377 |

| Battery | 24 months | 2,818 |

Wind projects had the highest wait times at the end of 2023 with an average age of 40 months (3.33 years). Solar projects, on the other hand, made up more than 40% of projects in queue.

Overall, reducing the time that these renewable energy projects spend in queues can accelerate the transition to a low-carbon energy future.

According to the U.S. Department of Energy, enhancing data transparency, streamlining approval processes, promoting economic efficiency, and maintaining a reliable grid are some of the ways this growing backlog can be mitigated.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

Energy Shift

All Commercially Available Long Duration Energy Storage Technologies, in One Chart

In this chart, we break down the parameters of LDES technologies that have commercial or pre-commercial readiness.

All Commercially Available Long Duration Energy Storage Technologies, in One Chart

Long duration energy storage (LDES) technologies can store electricity for 10+ hours, complementing intermittent renewables, boosting grid resiliency, and reducing fossil fuel dependency.

Created in partnership with the National Public Utilities Council, this chart lists the characteristics of LDES technologies that have commercial or pre-commercial readiness, using data from the LDES Council’s Net-Zero Power report and 2023 deployment update.

The Four Primary Types of LDES

Before getting into the details, let’s cover the four primary types of LDES.

- Mechanical: Stores potential energy (by tension or position)

- Thermal: Stores energy as heat

- Chemical: Stores energy found within chemical bonds

- Electrochemical (batteries): Stores energy of chemical reactions, where electrical energy is converted to chemical energy and vice versa

Currently, mechanical storage systems are the most common around the world. Aboveground pumped hydropower, for instance, currently accounts for 96% of all utility-scale energy storage in the United States.

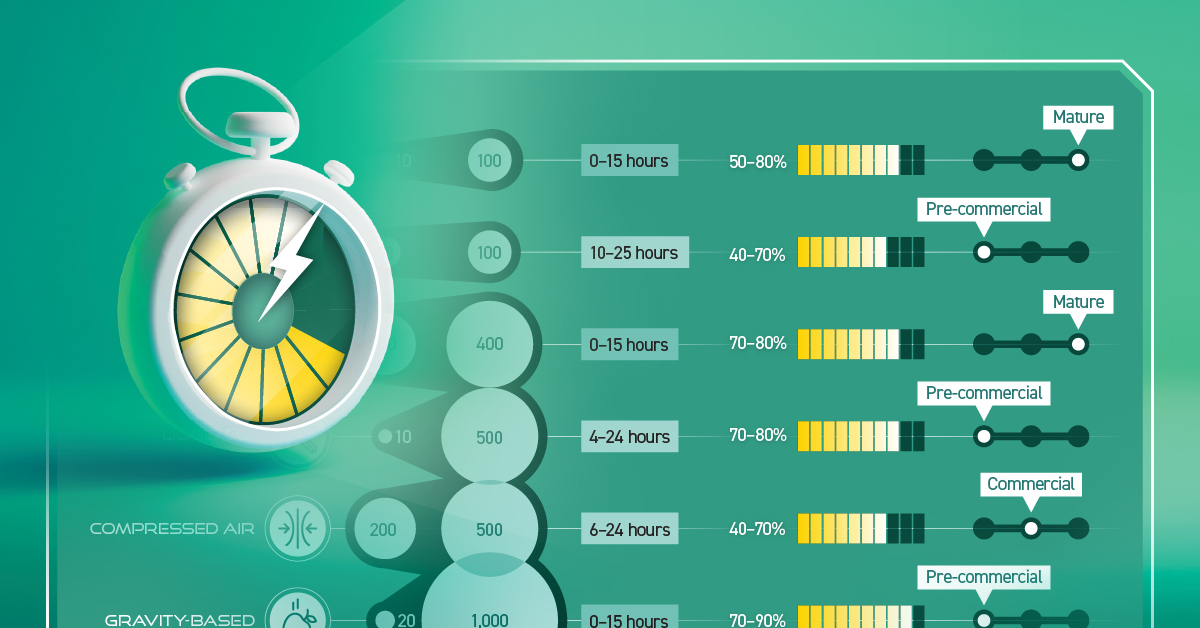

How Do LDES Technologies Measure Up?

Below, we list the storage capacity, storage duration, and average round-trip efficiency (RTE) of LDES technologies that have commercial or pre-commercial readiness on a global scale.

For context, RTE measures the effectiveness of a storage system by measuring the ratio of energy output to energy input during a full charge-discharge cycle. Or briefly, the higher the RTE, the lower the losses and therefore higher the efficiency.

| Form of Energy Storage | LDES Technology | Storage Capacity (MW) | Nominal Duration (Hours) | Average Round-Trip Efficiency |

|---|---|---|---|---|

| Mechanical | Underground pumped hydro | 10–100 | 0–15 | 50–80% |

| Mechanical | Liquid air | 50–100 | 10–25 | 40–70% |

| Mechanical | Aboveground pumped hydro | 200–400 | 0–15 | 70–80% |

| Mechanical | Liquid CO2 | 10–500 | 4–24 | 70–80% |

| Mechanical | Compressed air | 200–500 | 6–24 | 40–70% |

| Mechanical | Gravity-based | 20–1,000 | 0–15 | 70–90% |

| Thermal | Sensible heat | 10–500 | 200 | 55–90% |

| Chemical | Power-to-gas-to-power | 10–100 | 500–1,000 | 40–70% |

| Electrochemical | Aqueous electrolyte flow battery | 10–100 | 25–100 | 50–80% |

| Electrochemical | Metal anode battery | 10–100 | 50–200 | 40–70% |

| Electrochemical | Hybrid flow battery (with liquid electrolyte and metal anode) | >100 | 8–50 | 55–75% |

The table above shows that a mechanical, gravity-based LDES system can provide the highest storage capacity while presenting an impressive 70–90% average RTE.

On the other hand, a chemical power-to-gas-to-power system, which typically converts electricity to hydrogen gas and back to electricity, provides the highest storage duration of up to 1,000 hours.

With that said, there are different storage needs and siting considerations across electrical grids. Given the diverse range of options available, suitable solutions can be found to complement renewables and aid decarbonization.

Learn how the National Public Utilities Council is working toward the future of sustainable electricity.

-

Electrification2 years ago

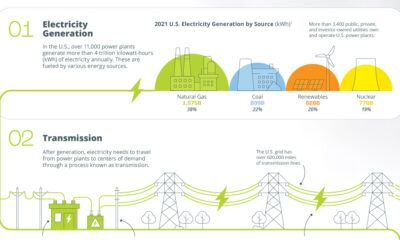

Electrification2 years agoVisualized: How the Power Grid Works

-

Energy Shift1 year ago

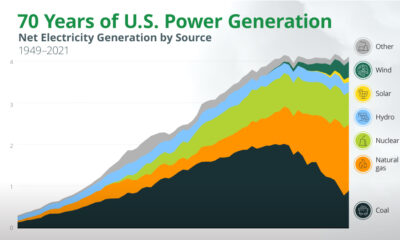

Energy Shift1 year agoAnimated: 70 Years of U.S. Electricity Generation by Source

-

Clean Energy1 year ago

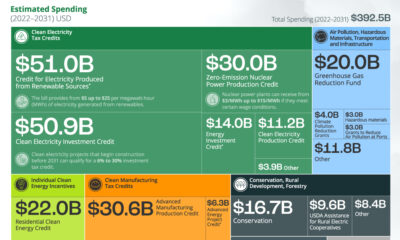

Clean Energy1 year agoBreaking Down Clean Energy Funding in the Inflation Reduction Act

-

Clean Energy1 year ago

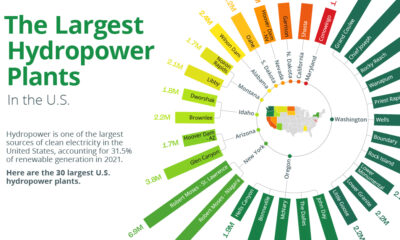

Clean Energy1 year agoThe 30 Largest U.S. Hydropower Plants

-

Emissions2 years ago

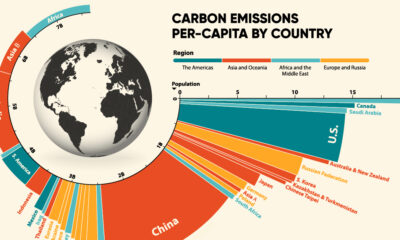

Emissions2 years agoVisualizing Global Per Capita CO2 Emissions

-

Clean Energy7 months ago

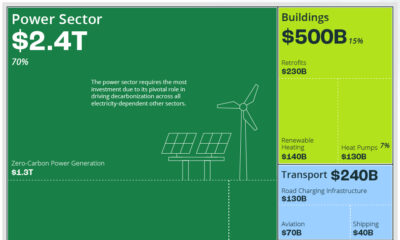

Clean Energy7 months agoBreaking Down the $110 Trillion Cost of the Clean Energy Transition

-

Decarbonization2 years ago

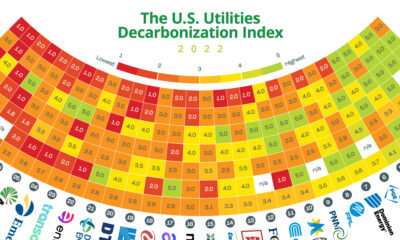

Decarbonization2 years agoThe U.S. Utilities Decarbonization Index

-

Climate1 year ago

Climate1 year agoVisualizing the State of Climate Change